Hedge funds swoop on Swedish match, piling pressure on PMI

Some of the world’s largest hedge funds have built stakes in Swedish Match, people familiar with the matter said, piling pressure on Philip Morris International Inc. to increase its USD 16bn offer for the smokeless tobacco company

Davidson Kempner Capital Management and HBK Capital Management have amassed some of the biggest stakes in Swedish Match, the people said, asking not to be identified because the information is private. They are both approaching the 5% level, equivalent to nearly USD 800m of stock, that would require disclosure, the people said.

DE Shaw & Co., Farallon Capital Management and Pentwater Capital Management have also bought stakes in Swedish Match, the people said. Including Elliott Investment Management, hedge funds collectively own at least 25% of Swedish Match after making investments worth billions of dollars, according to the people.

Some funds have already written to Philip Morris seeking an increase in the offer price, the people said. Shares of Swedish Match rose as much as 0.7% in early trading on Thursday. The stock was up 0.3% at 109.70 kronor at 09:31 a.m. in Stockholm, higher than Philip Morris’s cash bid of 106 kronor per share.

The proposal is already facing strong opposition from billionaire Paul Singer’s Elliott, which has a 5.25% stake in Swedish Match. While Philip Morris’s bid was originally conditional on getting more than 90% of Swedish Match, the Marlboro maker has been considering lowering the threshold to ease the deal through, Bloomberg News has reported.

Merger arbitrage funds that invest in listed takeover situations have found fewer opportunities this year, as surging inflation and slowing economic growth hamper global dealmaking activity.

Such investors can profit by exploiting the difference between a takeover offer and the current market price, or by pressuring suitors to increase their bids. The dearth of major transactions this year means that funds are sometimes making larger-than-usual bets on the few deals that are happening.

Representatives for Swedish Match, Elliott, DE Shaw and Farallon declined to comment. Representatives for Philip Morris, HBK and Pentwater didn’t immediately respond to requests for comment, while a representative for Davidson Kempner didn’t immediately comment.

A takeover of Swedish Match will give Philip Morris a vast distribution network in the US, the world’s largest market for smoking alternatives, and pave the way for the rollout of other products such as vaping devices.

Swedish Match is a leading maker of snus a smokeless tobacco product that users place between their upper lip and gum popular in Sweden but banned across much of the rest of Europe. The company also makes nicotine pouches called ZYN.

The tobacco industry has been shifting to potentially less harmful alternatives to cigarettes, and has been looking into products that aren’t even linked to nicotine, as smoking rates across the developed world drop and regulations become stricter.

Danske Bank AM’s new flagship hedge fund has been years in the making

Related articles

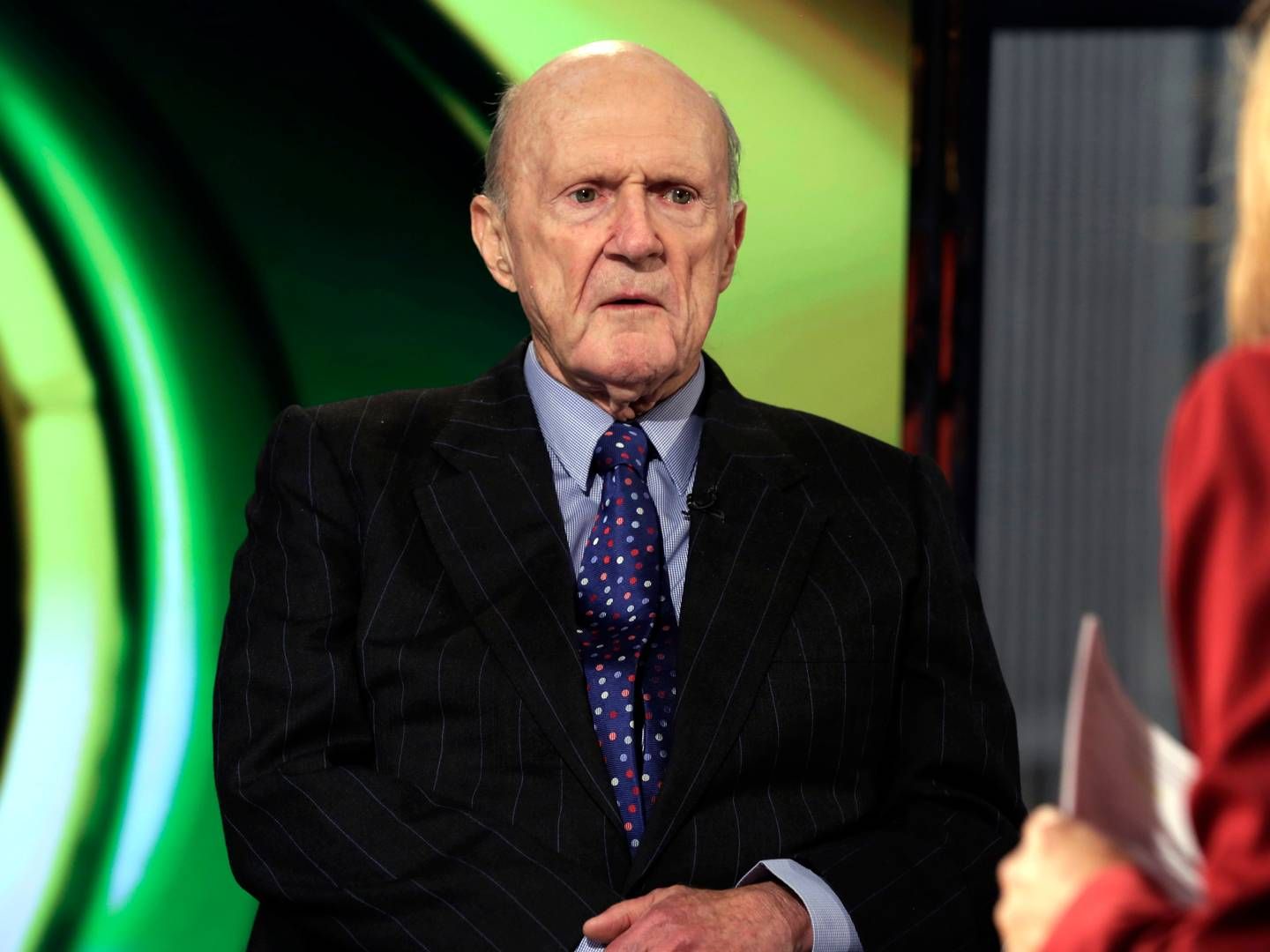

Julian Robertson, hedge-fund guru to ‘Tiger Cubs,’ dies

For subscribers