Finland's EUR 72bn asset manager: Reporting will become the real ESG product differentiator

OP Financial Group currently sees an increasing demand for products with an environmental, social and governance tilt.

This trend is confirmed in a report by Morningstar named “The evolving Approaches to Regulating ESG Investing” which states that the demand for ESG investments is increasing to a point that it is becoming mainstream:

“In Europe, 290 ESG-oriented open-end and exchange-traded funds were launched in 2018, and assets under management grew 40% over the four years to the end of 2018 to stand at EUR 684 billion. While 2018 saw a 40% dip in flows to EUR 37.4 billion from the previous year's EUR 57.9 billion, it was a lot less than the 80% slump in flows to the overall European fund universe. Passive sustainable funds bucked the overall trend with an increase in assets of 5.3% to EUR 76.9 billion.”

But how do asset managers keep up with this demand, and how do they differentiate their product offerings from the competition?

All types of clients seek information

The OP team works to discern the company through their ESG measurement, tracking and reporting – a business area that has seen an increasing demand from institutional as well as retail customers.

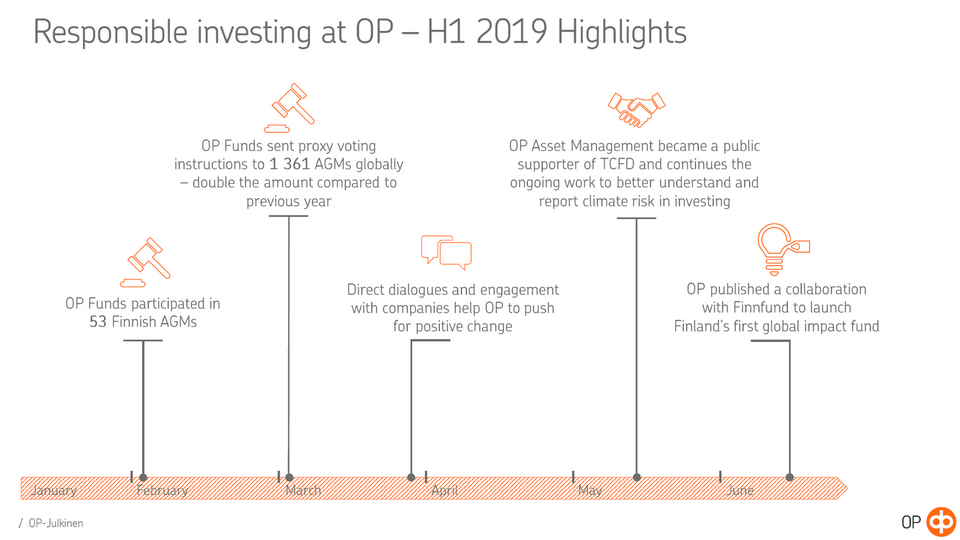

Currently, OP writes a semi-annual RI Transparency Report, calculates semi-annual carbon footprints of all investment funds, updates a monthly list of excluded companies and develops fund specific ESG reports.

For the company’s real estate investments, it provides an annual report on the properties’ environmental impact, including energy consumption, heating energy and water as well as the amount of produced waste.

"I feel certain that providing products with measurable sustainability metrics and being transparent by supplying solid and meaningful ESG reporting will become a way to differentiate your offering to customers." Manninen explains.

"It is a very challenging task and we have spent a lot of time developing ways to measure and report ESG. I’m not saying that we do it perfectly, but I think we have a great foundation and we will continue to improve," she adds.

Need for unification

Writing reports is one thing, correctly measuring impact is quite a more complex exercise. The OP team hopes for an international or European standard against which to measure investment impact.

“A shared standard for measuring the impact of our investments would enable us to identify the origin of real risks and would allow us to understand ways for the financial industry to support the broader global goals and positive change, including climate change mitigation and adaption,” says Manninen while acknowledging that ESG cannot be simplified as a ‘one fits all’ score card.

Manninen is not alone in seeing this urgent need. According to Morningstar’s earlier mentioned report, defining a taxonomy for sustainable investments is critical.

“Without such definitions, investable products will be difficult to compare, resulting in investor confusion. A consistent taxonomy and set of requirements will reduce the potential for ‘green-washing’,” the research firm writes.

Launching Finland’s first impact fund

Another way to differentiate from the competition is launching unique products.

OP Financial Group recently announced that they will launch a global impact fund in collaboration with a Finnish DFI – the first of its kind in Finland.

In a statement from June, when OP announced their plans for the impact fund, OP Head of Asset Management for Corporate and Institutional Customers Tuomas Virtala explained that an increasing demand for impact investments among OP’s investors was the reason for the company to launch an impact fund.

"It is an institutional fund that we launched along with Finnfund. The fund will invest in emerging markets, defined by the OECD, primarily in sustainable agriculture and forestry, renewable energy and financial institutions projects," Manninen explains to AMWatch, adding that the company will market the fund from this fall.

Starting a thematic engagement on plastic and circular economy

Moreover, in its ESG activities, OP tries to distinguish itself through a more theme-based approach. OP is part of a collaborative engagement on Plastics and Circular Economy, which is coordinated by engagement provider Sustainalytics.

For this theme, OP, Sustainalytics, and other investors will engage with 20 companies based on Sustainalytics’ research on industries that utilize large quantities of plastics or play significant roles in plastic waste and could benefit from a circular economy-based business approach.

All engagement themes present clear targets and KPIs. The service provider contacts the companies and organizes meetings and calls in which investors may participate. Each company has a few annual meetings and calls and the agenda is based on the relevant targets and KPIs.

“Basically, we aim to open a dialogue with these companies on a certain topic and push them to better understand the risk. We are active call participants, we ask questions and take part in the discussions,” Manninen concludes.