Asset managers boost sustainability offering but no standardization

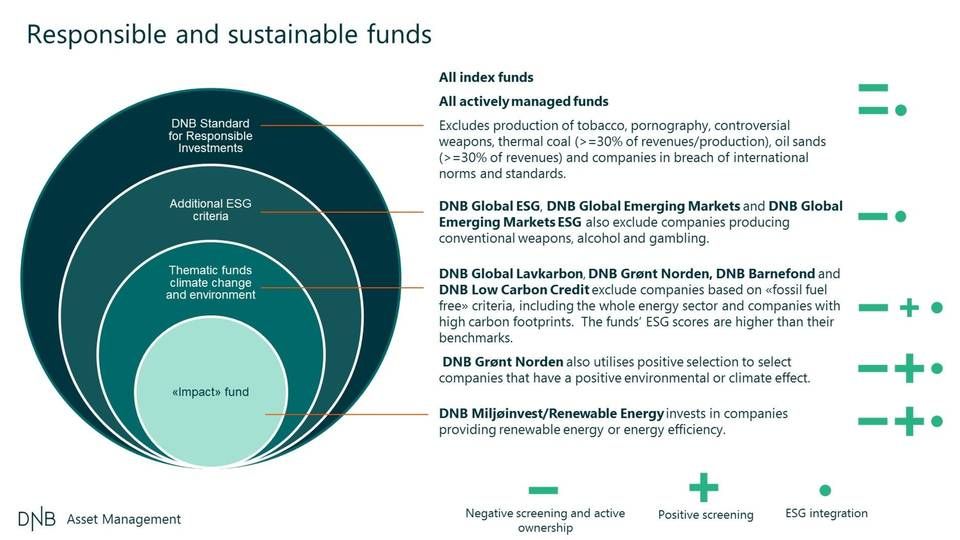

BANK-OWNED ASSET MANAGERS' ESG ASPIRATIONS: The number of funds with an ESG, impact or sustainability label has soared in recent years and will continue to do so in the years to come. However, the lack of standardization makes product comparison difficult for investors.

BY CAMILLA JENKEY

Responsible investments, environmental, social and governance investments, sustainable investing, socially responsible investments, or even ethical investments.

Already a subscriber?Log in here

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.