Danske Bank WM's head equities and risk premia: "Our ambition is to develop a cutting edge cross-asset platform"

This interview was conducted prior to last week’s organizational change, where Otbo also assumed responsibility for the equity department, and hence focuses solely on the risk premia ambitions.

When Thomas Otbo became part of Danske Bank Wealth Management in November 2019, he had one overarching objective: To develop a cutting-edge, cross-asset risk premia platform.

"One of the things that lured me to Danske Bank was the outspoken ambitions in risk premia and the possibility to develop an area which I believe will have major impact on how the asset management industry will evolve," Otbo explains to AMWatch, adding that the first stage of his mission is to establish an understanding among clients that this is an area Danske Bank prioritizes strongly for the future across most asset classes.

"The only reason factor investing started in equities is purely down to legacy," he explains. "However, evidence suggests that a systematic and disciplined approach to security selection works across asset classes," he says, mentioning high-yield bonds and commodities as examples.

AMWatch interviewed Otbo to discuss his plans, ambitions and what drove him to move from his position as chief investment officer at Nordea Asset & Wealth Management to become Danske Bank Head of Risk Premia. Since the interview, his risk premia title has been accompanied by a new role: head of equities.

Otbo notes that his objective – in addition to upgrading existing products and launching a number of new products - is to establish a platform to enhance the nature of asset management products for the future, focusing more on risk management and bespoke solutions.

"An example could be a client that wants a systematic strategy with a value factor style approach because value appears cheap on valuation multiples. Another example could be a more advanced alternative risk premia strategy going long in relatively cheap assets while shorting expensive ones," Otbo says, adding:

"The platform needs to have the potential to meet any given client preference."

First generation ARP strategies

Otbo started his career in the world of finance as an analyst at the Danish Ministry of Finance in 2002, monitoring the performance of state-owned enterprises. This was during his years at Copenhagen University, where he completed an M.Sc. in Economics, opening the door for the first of his three career tenures at Nordea, working with private equity funds.

Otbo later got to work with more complex investment tools, including derivatives-based hedging solutions, as senior analyst at Nordea, where he worked until 2011 before moving to London to work for Goldman Sachs.

"Among many other things, I was involved in developing some of the first generations of advanced alternative risk premia long-short investment strategies at Goldman Sachs," he recalls. "This was highly challenging from an investment perspective and something I use a lot in my work developing Danske Bank's inhouse risk premia platform," he says.

3,168 shades of value

There is no universal interpretation of risk premia investment strategies and all asset managers tend to have their own definitions, Otbo says early in the interview.

"I usually start by highlighting the most well-known risk premia of them all, which is the equity risk premium, i.e. as an investor I expect to get a positive return when I invest in equities. While other risk premia investments might be slightly less well-known, the same principle applies, i.e. am I being compensated for taking on a certain risk in the markets?" the former Goldman Sachs director says.

"It’s usually implemented via a disciplined and systematic investment approach, where the fund manager is less focused on generating traditional alpha and more focused on finding the best and most efficient way to implement the relevant risk premia strategies," he adds.

The best known factor styles are value, momentum, carry, low volatility, quality and size. Even though most risk premia are well described in financial literature, the ability to make some different adjustments to their peers gives an asset manager the ability to stand out. Otbo draws a parallel to fundamental long-only equity fund managers for whom most investment processes are unique.

"The same applies within systematic investing. All asset managers do this differently despite the systematic and disciplined approach," he says.

The equity value premium can be described intuitively as "buy low, sell high". However, according to a recent study published in the Journal of Portfolio Management by Stephan Kessler from Morgan Stanley, there are no less than 3,168 ways to do it, suggesting that there seems to be no consensus around what value actually is.

A recent annual factor investing study by Invesco shows that 59 percent of existing factor investors plan to increase their allocation to these strategies. At Danske Bank Wealth Management, more clients also want these solutions to become part of their portfolio.

"However, some investors – based on their individual profile - need to allocate a non-trivial part of their portfolio to factor-based strategies to have a meaningful impact on the portfolio. This, however, is possible as these strategies tend to be liquid, scalable and transparent," Otbo says, adding that it’s him and his team of four portfolio managers that decide which quantitative signals they use in their factor-based security selection.

Partnership model

Danske Bank recently launched a multi-factor equity fund with AQR Capital Management. According to Otbo, the ability to team up with external partners provides Danske Bank with a great degree of flexibility when determining which investment solutions can yield the highest expected return over time, as they do not need to consider whether a solution is developed in-house or alongside a partnering firm.

"This means that we often discuss how to improve investment strategies with partners like AQR Capital Management or Goldman Sachs," he says. "Danske Bank's size in this space makes us an attractive partner for global investment banks and external asset managers, while we are still large enough to hire skilled professionals from the outside to develop it internally."

He emphasizes that determining which solution will provide the best fit for clients is always a qualitative assessment.

"In the end, we only have one ambition, which is to deliver strong performance to our clients. Most likely, our final offering will be a combination of internally and externally produced products," he says.

The reason why this investment area has gained a lot of traction in the past decade stems from two major issues facing all investors: Lower expected returns in the future and fewer benefits of diversification in investment portfolios.

"Part, but not the whole answer, may be alternative risk premia," Otbo says.

High valuation multiples

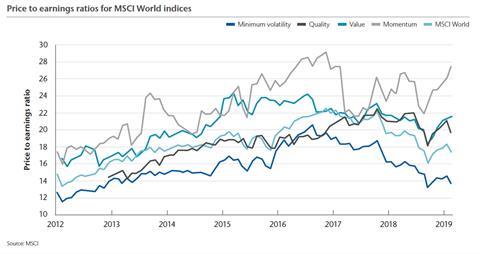

The lower expected return challenge is a result of a decade of lowering interest rates and strong equity markets, resulting in high valuation multiples. Meanwhile, it may be difficult to imagine interest rates dropping even lower, and in many instances, further into negative territory.

For many Nordic investors, one way to meet this challenge has been to allocate capital to illiquid alternatives, aiming to provide diversification, and thus a smoother fall in case of a big market correction, as well as an illiquidity premium.

"However, private equity valuations are also expensive. Additionally, there are much higher debt multiples and we have started to see some of the same signals as prior to the financial crisis and if the liquidity that drove the market up is removed, all assets might fall simultaneously at some point," Otbo says and underlines that this is only a scenario and not something that is bound to happen.

He adds that risk premia investments should, over time, deliver both returns and diversification, and could thus be an attractive solution to improve investor portfolios given the current market outlook.

No fear of crowding

A growing concern among factor investors is whether the significant inflow into smart beta ETFs, quantitative mutual funds and quantitative hedge funds in the past decade has led to a crowding effect, or overcapacity, resulting in diminishing excess returns for investors entering the scene at this stage.

Otbo acknowledges that it is important to be aware of crowding. He says that Danske Bank has done internal studies on crowding effect, which did not indicate that the alternative risk premia are being traded or arbitraged away.

"Another way to look at this is that some of these strategies have not performed according to expectations in 2018 and in particular 2019, and when something tends to become crowed, it's usually because it attracts a lot of inflow leading to higher prices. This has not been the case," he says and mentions the equity value factor as an example.

"Even though value is one of the most well-described style factors, it's currently trading at close to all-time- low multiples. It's too simple to say that factor-investing is crowded. You need to assess each factor individually as they move in cycles in terms of valuations and outlook," he says, adding that he meets with his investment team on a weekly basis to discuss issues such as these.

Aren't you worried that Danske Bank has missed a lot of the early upside by only starting to prioritize this area at the same level as fundamental and index strategies a bit too late to really get the best out of it?

"The fact that some of these strategies have delivered poorly in the past two years don't indicate it. I believe, in contrast, that the timing is better than ever," Otbo replies.

Why do you think the timing is better now than earlier?

"We look into a future of lower expected returns and less benefit from portfolio diversification and factor investing has shown to deliver excess performance over time. In terms of solutions, I also believe now is a better time because there has been a lot of research and product development over the past five years allowing us to benefit from these advancements."

Another thing he mentions is that clients are increasingly actively asking for these solutions. "Those three factors are why the timing is better now than before," he says.

How much do you hope to achieve in 2020?

"I would like to stand on target for having established a clear understanding across Danske Bank Wealth Management and among our clients that this is an important topic for the future and that we have big ambitions in this area."

Three things needed to thrive

For Otbo personally to experience his tenure as a success, he needs three things to be in place for him to thrive: A professional investment challenge, a leadership challenge, and lastly, a commercial challenge. If we can’t commercialize the investment challenge and help our clients at the same time, it won't matter, as he puts it.

Given your background and previous positions, why did you choose this job at Danske Bank?

"I truly enjoyed my tenures at both Goldman Sachs and Nordea. However, I felt that this was a unique opportunity for me to combine my passion for investments, leadership and commercial focus working in one of the most exciting areas of finance," he says.

"The asset management industry is under pressure, notably from falling fees, and there is a strong need to come up with new and innovative solutions. With high ambitions and a very strong client focused culture, I feel that Danske Bank will be very well positioned in this industry going forward," he adds.

Assets under management at Danske Bank Wealth Management totaled EUR 220 billion by the end of last year.

Investment duo to gain more responsibility following alpha head's exit