Renaissance says quant models misfired during March mayhem

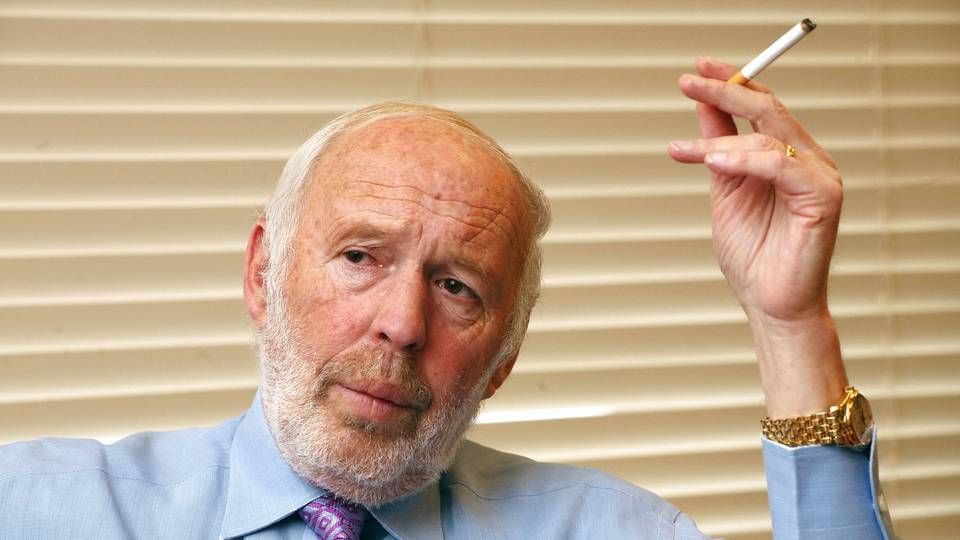

Computer models at Renaissance Technologies, the firm founded by the mathematician and former codebreaker Jim Simons, misfired when volatility surged this year, contributing to a first-quarter loss at its largest hedge fund. The beta models, which help determine portfolio exposure at funds for outside investors, “in recent volatile markets have not performed as expected,” Renaissance said in a March 30 filing.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.