An AQR warning and a 3,612 % return fire up the black swan debate

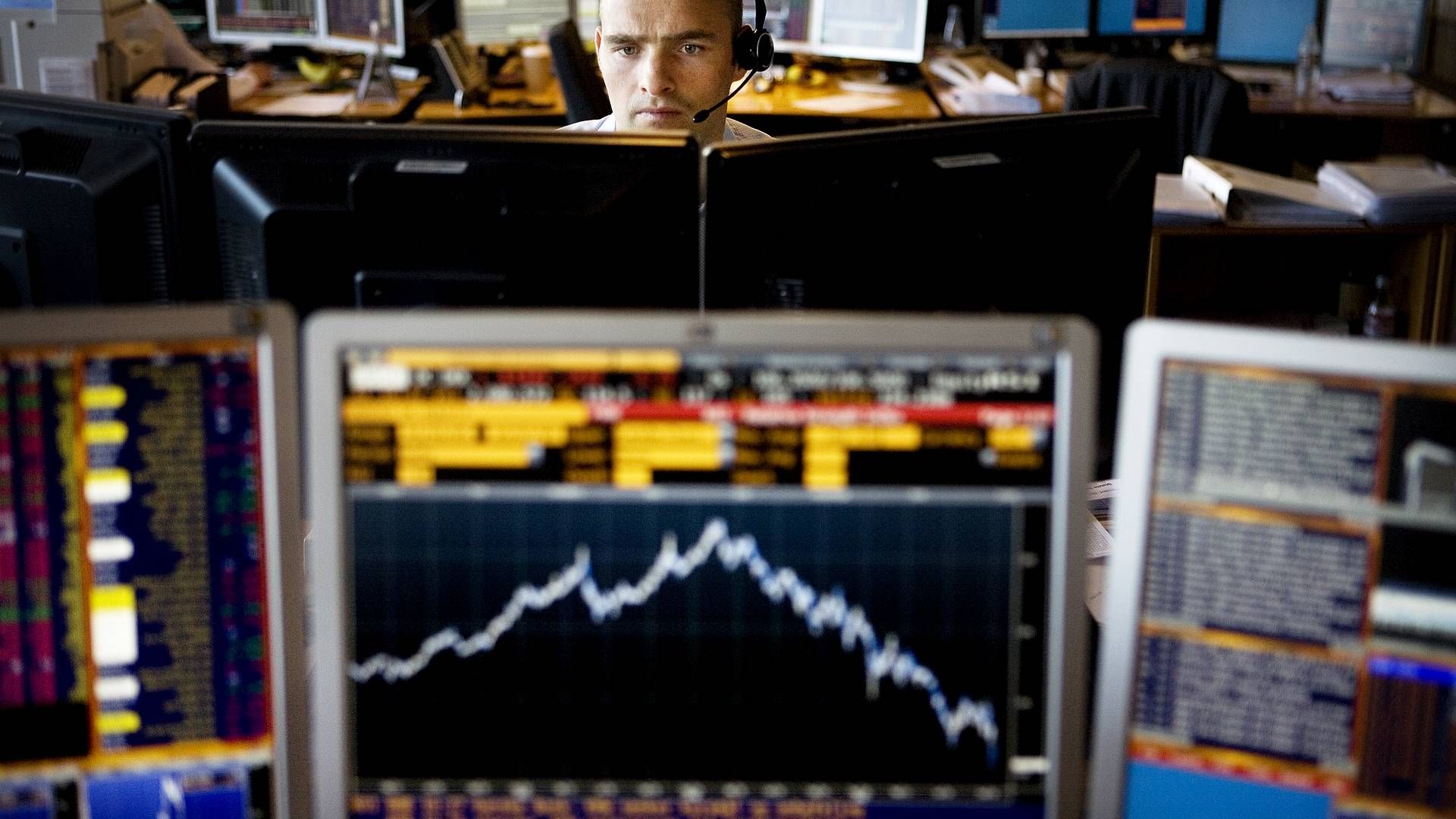

As stock turmoil recedes and fund managers the world over contemplate hedging against the next big crash, options-based defensive strategies have been dominating the headlines for making a killing in the sell-off.

That’s stoking a fierce Wall Street debate, pitting proponents of tail-risk hedging for a volatile world against those who warn insurance premiums can eat long-term returns.

Count AQR Capital Management LLC among the doubters. The USD 143 billion quant pioneer is cautioning investors that those eye-popping March figures bely the expense of being constantly prepared for doom.

It argues that the protracted drawdowns do the most damage for long-term-investors rather than short and sharp shocks.

“Recent headlines focus on option-buying strategies and their extraordinary performance in March, usually leaving out their generally high long-term cost,” AQR’s portfolio solutions group wrote in recent research. “The tail insurance strategies with the largest wins in crash months are likely ones that in good times lose all or most capital allocated to them, perhaps many times over.”

Quants are vying to win back hearts and minds after defensive systematic strategies misfired in the virus-spurred meltdown while options-based alternatives stole the limelight. But AQR’s entry into this raging debate among real-money funds is timely.

With the S&P 500 up more than 25 percent from its March low, investors may well be asking if this is the moment to buy portfolio insurance via protective puts and, if so, whether it’s cost effective.

It’s an issue that’s weighed on California Public Employees’ Retirement System, the largest public pension fund in America, after it faced scrutiny for eliminating a tail-risk hedging program just weeks before the crash.

Options-based hedging strategies come in all shapes and sizes. It’s the bread and butter of tail funds, which typically take deep out-of-the-money positions to profit from extreme market stress. One such firm, Miami-based Universa Investments, returned 3,612% in March.

The Universa proposition is that by allocating just a small portion of their holdings toward crash protection, investors can take a more aggressive approach with the rest of their portfolio. In a letter to investors last month seen by Bloomberg News, Chief Investment Officer Mark Spitznagel included a table showing a portfolio invested 96.7 percent in the S&P 500 and 3.3 in Universa’s fund would have come out of March unscathed.

This particular allocation has also outperformed the S&P 500 since March 2008, according to the investor letter, in a challenge to AQR’s claim that tail-hedging costs eat away at returns over the long haul.

Nassim Taleb, author of the 2007 bestseller “The Black Swan,” is the scientific adviser for Universa. He’s dismissive of AQR’s warning over tail-risk bets, suggesting the defensive approaches of the two firms should not be compared.

“It is a waste of time comparing boxed wine and a French Bourdeaux,” he said by email via a spokesperson.

AQR didn’t look at the kind of tail-risk hedged stock portfolio Universa advocates. Instead its research sought to offer an insight into the performance of options protection over time by including baskets of out-of-the-money puts during periods of market volatility when traditional portfolios suffered and defensive derivatives would have performed well.

The team crunched several decades of data to compare various strategies versus a 60/40 allocation over the course of a series of “bad outcomes” lasting from a week to 10 years.

They found that a portfolio of out-of-the-money put options on the S&P 500 wins handily in short-term negative events, but the ongoing costs lead to underperformance during bad periods lasting longer than about three years. Quant styles like trend following and risk parity prevailed in the end.

Time Crisis

Like many systematic firms, AQR has had a tumultuous time of late as various strategies favored by quant investors have struggled. But the team’s conclusion about hedging remains faithful to its core proposition that investors should take a long-term view, and be more concerned about lengthy drawdowns than sharp shocks.

Markets have so far been rescued by a mix of unprecedented stimulus and the slowing spread of the virus, but can hardly be considered out of the woods. Economies remain stalled, and it’s unclear whether and how fast activity can return to normal, or if a second wave of the virus will hit when it does.

Fundamental shifts like monetary support and the rise of passive investing may have also altered the nature of downturns, making lengthy drawdowns less likely and increasing the chances for violent spasms.

Universa’s Spitznagel told investors the world remains trapped in an “unprecedented central-bank-fueled bubble,” leaving markets riddled with systemic vulnerabilities. The firm maintained protection against more equity declines even as it cashed in many of its positions, he wrote.

The problem with using options-based defensive strategies now may be their popularity, especially after all those headlines about gargantuan returns. The cost for protective options on the S&P 500 has eased since March, but remains far more expensive than before the rout.

“If we’re in the middle of a crisis, a tail risk isn’t a tail risk anymore, it’s just another potential scenario,” said Nikesh Patel, head of investment strategy at Kempen UK. “And once it’s another potential scenario, it becomes very expensive to protect yourself from it.”

Goldman Sachs Asset Management has reached a similar conclusion.

The firm sees the potential for further market downside given the likely gradual path to reopening economies and overall lingering uncertainty, according to Shoqat Bunglawala, who heads the global portfolio solutions group for Europe, the Middle East, Africa and Asia Pacific. But tail-risk hedges are not its protection of choice.

“We prefer to adopt a moderately cautious position through a small underweight to equities, ensure appropriate diversification through bonds and alternatives and take advantage of tactical opportunities,” he said.

War of Words

Traditional hedging approaches may also turn out to be as effective for protecting a stock portfolio as an options approach, or more so, depending on the goals of the portfolio’s owner.

California’s giant pension plan, known as Calpers, said the alternatives it put in place after cutting its tail-risk hedging program which included factor-weighted equity exposure and long-duration Treasury holdings offset $11 billion of losses during the March sell-off.

Over at FactorResearch, Nicolas Rabener analyzed risk-adjusted returns both for tail-risk funds and cash-like assets between 2007 and 2020. It showed both resulted in similar risk-return ratios and drawdowns.

His conclusion? Short-term bonds provided similar benefits, while tail-risk funds tend to be most in demand when they’re least attractive like now.

“A tail risk fund is somewhat like a roller-coaster at Disneyworld in Florida,” Rabener wrote. “The experience is primarily waiting uncomfortably for a long time in sweltering heat rewarded by a few brief moments of glorious joy.”