Bridgewater’s risk-parity shift jolts a USD 400bn quant trade

The USD 400bn corner of quant investing known as risk parity has a history of doubt and division, and Bridgewater Associates has started a new chapter.

By Justina Lee / BLOOMBERG

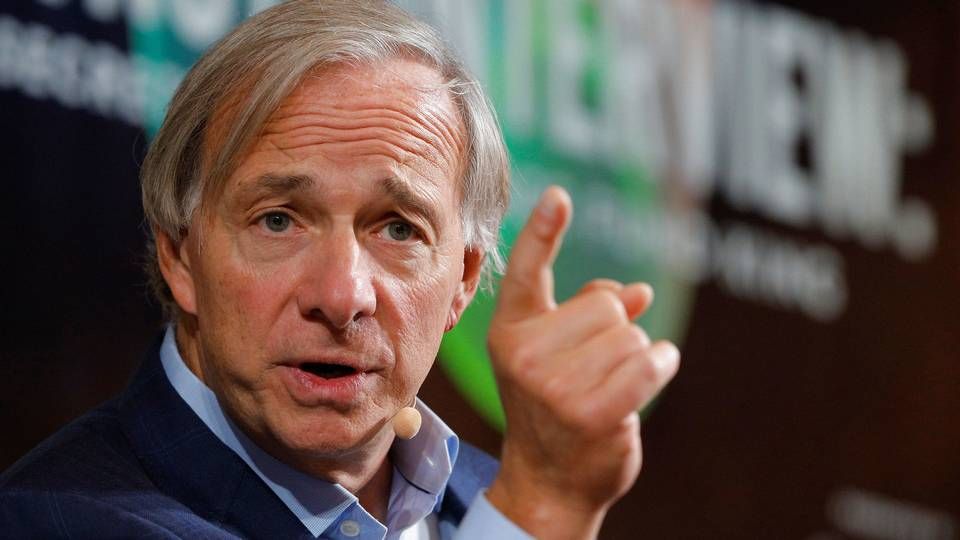

Ray Dalio’s USD 138bn asset manager has tweaked its version of the strategy by moving into alternatives to conventional bonds as yields hit historic lows, a person familiar with the matter has confirmed.

Already a subscriber?Log in here

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.