Surge in energy demand accelerates need for green transition

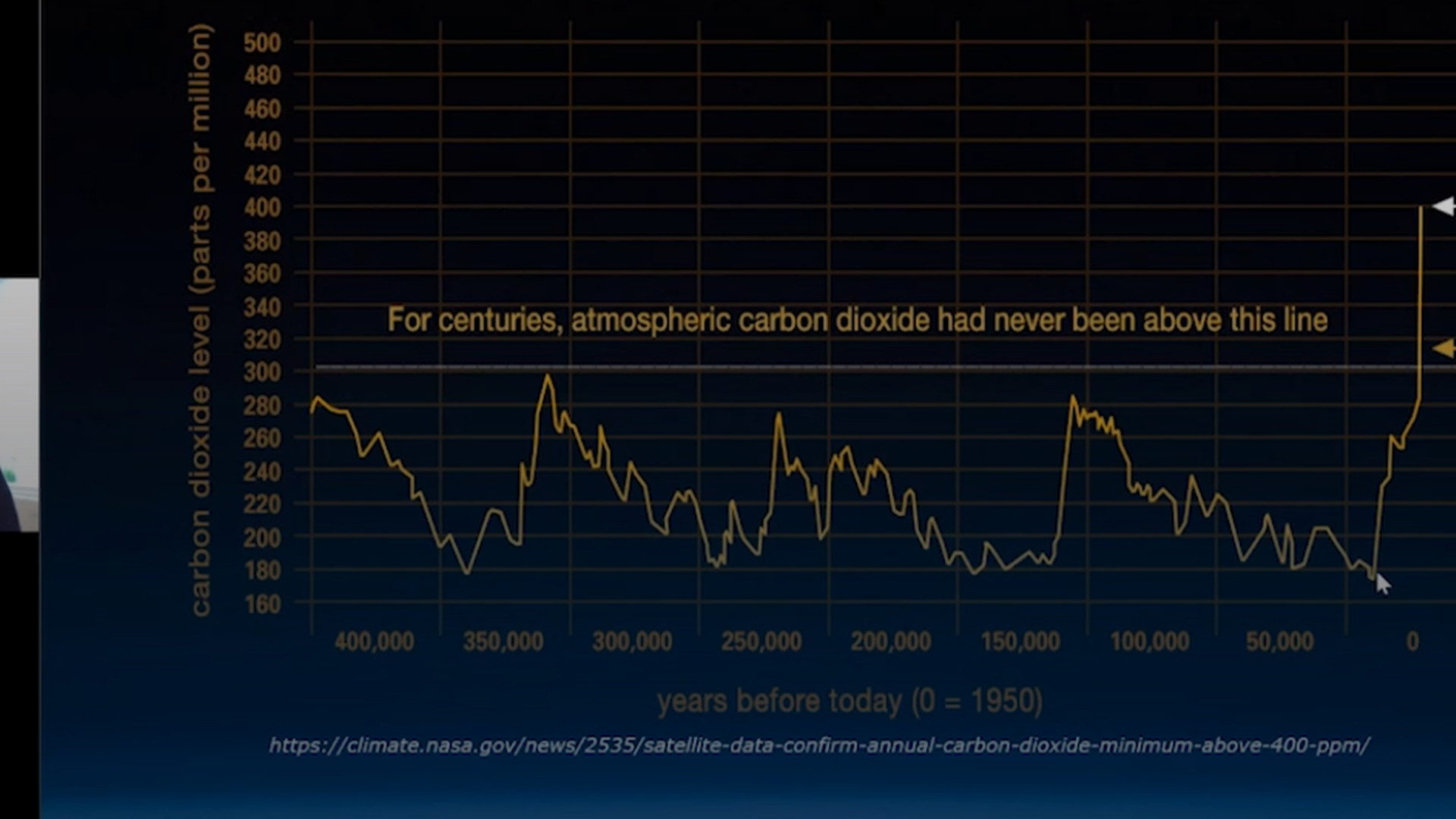

"If we keep burning fossil fuels at the rate we're currently doing, then by the end of this century we could have 1,000 parts per million of carbon dioxide, which is a real concern, because the last time we had that was around 55 million years ago at the end of the Paleocene. At this time, temperatures were somewhere between 10 and 13 degrees warmer than today, and there was no ice on the planet at all."

These are the words of Martin Siegert, professor of geoscience and co-director of the Grantham Institute on Climate Change. The climate scientist warns that this could mean sea levels would rise by up to 60 meters. However, that's even not the biggest issue:

"The major problem is that the rate of change is so much greater than the world has experienced previously," Siegert said to Nordic pension investors last week at a seminar hosted by BNP Paribas Asset Management last week.

"When we came out of the ice age, it took 10,000 years to naturally go from 180 parts per million to 280 parts per million. We are doing it in 50-60 years, meaning 200 times faster than the natural world could do it," Siegert continued.

When carbon dioxide enters the atmosphere, it takes a while before naturally depleting, and emitting additional carbon dioxide will extend the time needed to return to equilibrium. The last time the concentration of atmospheric carbon dioxide passed 400 parts per million was around three million years ago during the geologic Pliocene period (5.3m-2.58m years ago). Back then, the sea level was around 20 meters higher, while the average global temperature were approximately 3-4 degrees Celsius warmer than today.

According to the professor Siegert, the easiest way to reduce global carbon emissions is to decarbonize the energy sector by discarding fossil fuels and increasingly switch to renewable energy sources. Carbon emissions from energy-related activities are making all-time highs, standing at 33 gigatonnes today and responsible for 70 percent of total carbon emissions.

Basic infrastructure

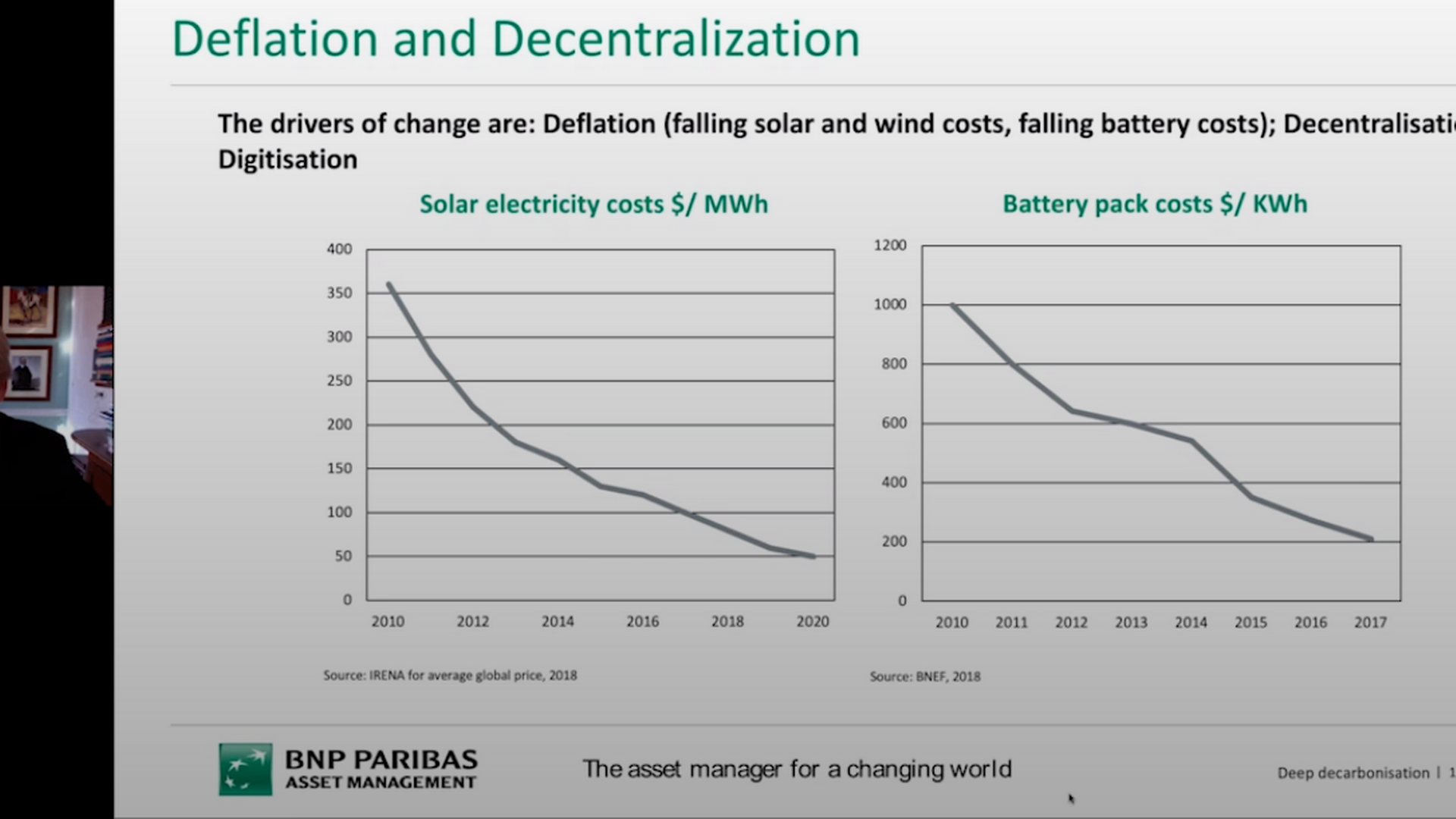

The second speaker at the seminar was Mark Lewis, chief sustainability strategist at BNP Paribas Asset Management, who argued that renewable energy is intrinsically deflationary because it's basic infrastructure.

"You don't need to explore for solar or wind energy because you know where the sun shines and where the wind blows, so you need to build in the places best suited to capturing it," Lewis told the audience.

He highlights that this results in renewables being a less risky asset compared to fossil energy, because investors have a higher degree of visibility of future earnings from renewable projects. Lewis highlighted that solar energy had fallen by 80-90 percent in terms of average cost of production.

"There are further reductions to come. The story is the same for offshore wind and energy storage. Energy storage will be the big story for the coming decade," Lewis said and continued:

"The price will continue to fall because we are in this positive feedback loop between public policy, technology, investor preference and societal preferences. All these factors are pushing the energy transition."

Lewis believes that oil will need to trade at USD 9-10 per barrel over the long-term to remain competitive.

"Oil and gas are now facing the same existential challenge that fossil-fueled electricity generation faced 10 years ago," he said.

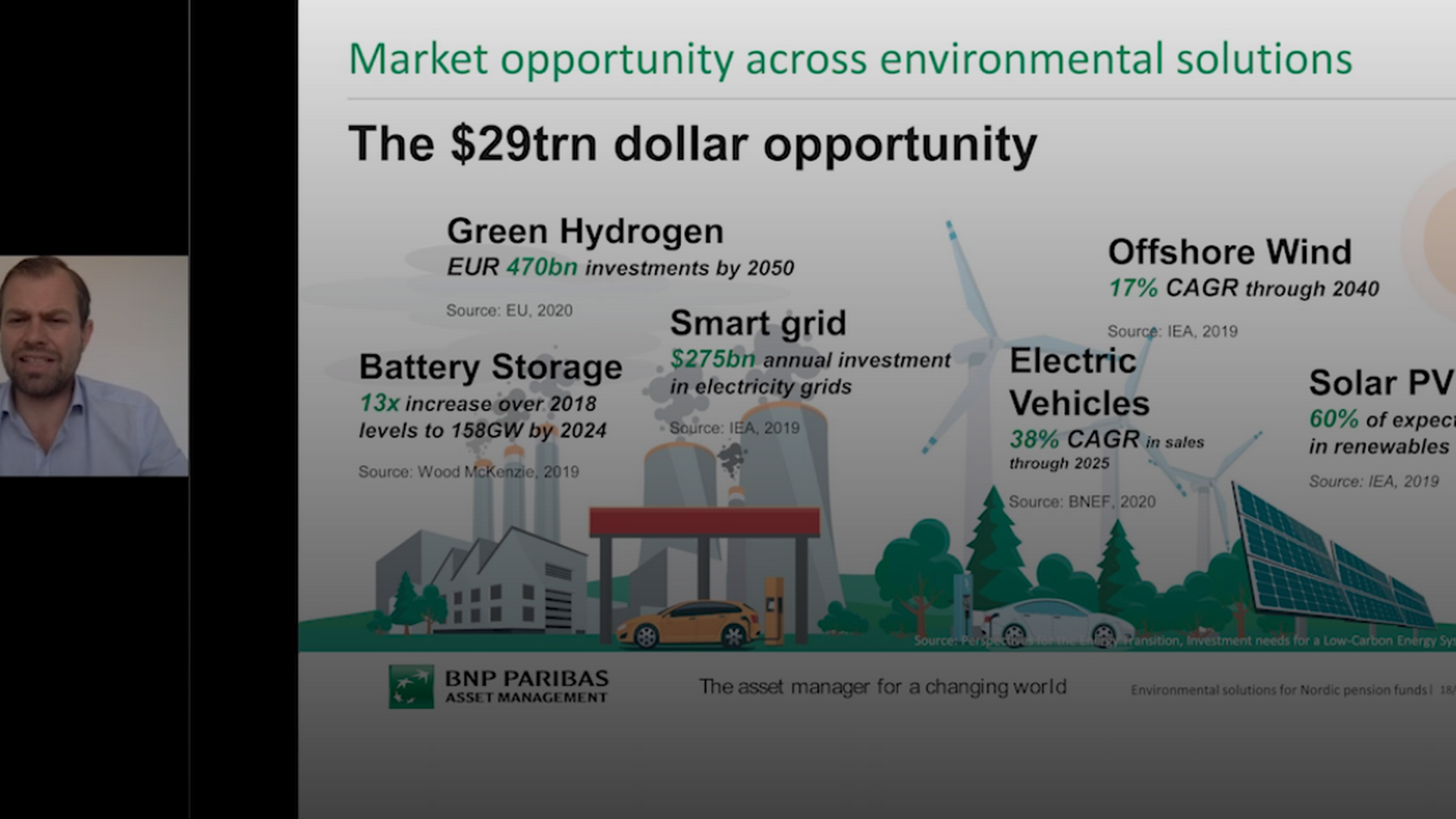

The USD 29trn dollar opportunity

The last speaker was Ulrik Fugmann, a Danish national who runs two of BNP Paribas Asset Management's strategies in his role as co-head of environmental strategies: Energy Transition is up by 111 percent year-to-date, and an absolute return fund called Earth is up by 22.5 percent since its July launch.

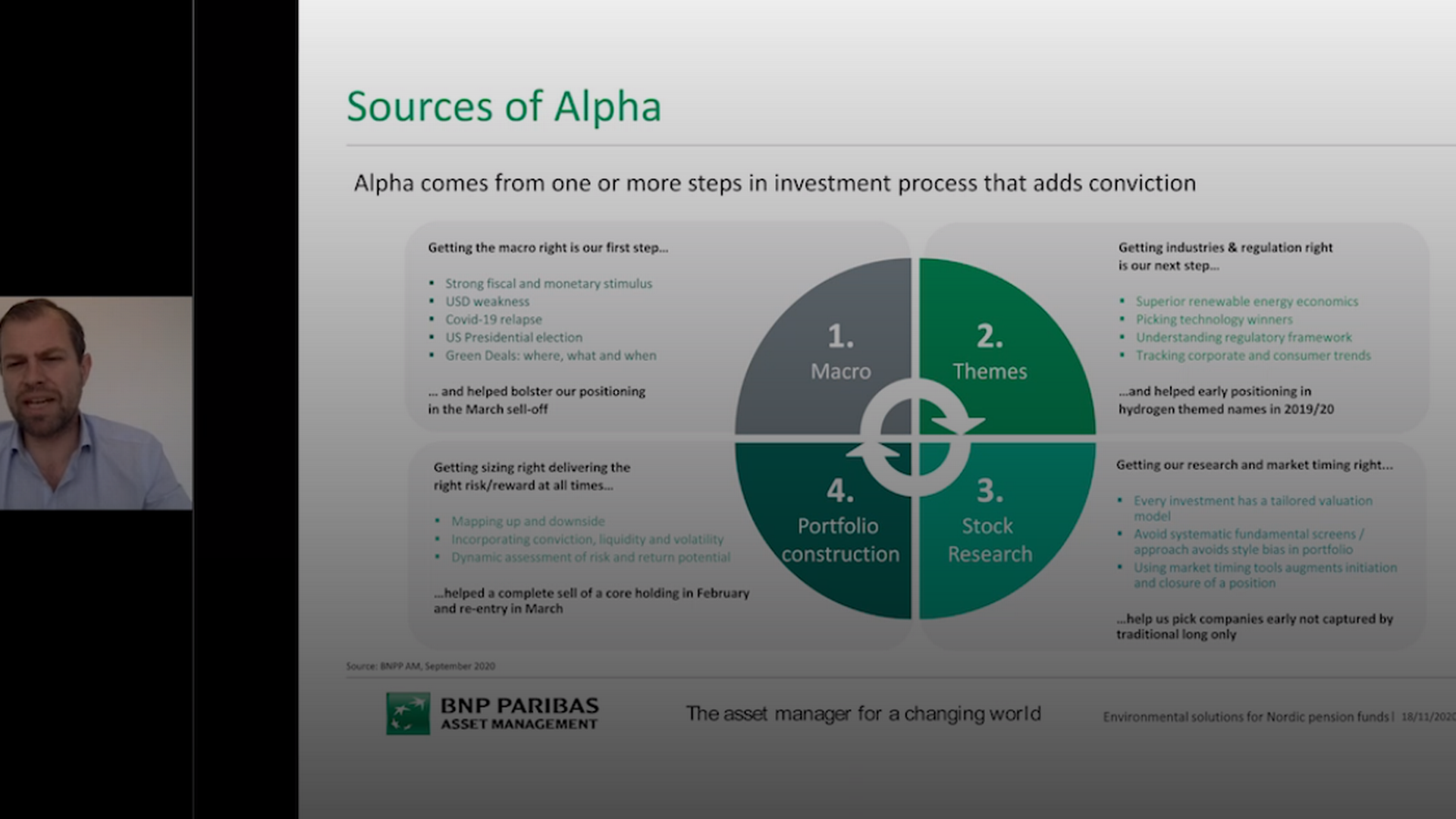

As a thematic investor within energy transition, Fugmann starts off by assessing how his theme fits the overall macro environment, emphasizing that the energy transition is a simple story that builds upon expected global population growth of 2 billion by 2035, urbanization and rising incomes.

"This [population growth, -ed.] will create a substantial additional demand for energy and power intensity. If you take China and India in isolation and bring their energy intensity to the levels of Germany today, that would add 40 percent to the global energy demand," Fugmann said.

What brings the seemingly opposing dynamics of rising demand for energy while significantly reducing energy-related carbon emissions in balance are companies providing environmental solutions. These are companies that participate in the decarbonizing, decentralizing and digitalizing of the global energy system.

"We have just seen the beginning of this transition that, unfortunately, remains currently off track in meeting Paris Agreement goals, but with recent government initiatives across the world, things look increasingly possible," Fugmann said.

In the hunt for future winners, it's important to have an all cap investment mandate as a lot of innovation in terms of solutions come from younger and smaller companies, Fugmann told the audience.

"This is, for instance, how the hydrogen fuel cell theme played out this year. It was not big cap but smaller companies with innovative and proven technologies that would stand to benefit in this explosive addressable market. Today, sizeable mid cap companies were considered small cap companies only 8-12 months ago," he said.

"Having an active approach, an all cap perspective on your portfolio, being able to look through different sizes of companies and value those in a bespoke manager whilst avoiding a fundamental stylistic bias, is incredibly important," he added.

Afterwards, Fugmann highlighted that companies with a high score on the environmental factor [by third party providers, -ed.] tend to perform better during major market drawdowns.

"That doesn't mean that there aren't companies within our space that can be overvalued. Our space is just as prone to general supply and demand as any other sector, which is where an active and selective mindset helps investors navigate this area towards tomorrows winners today," he said and added:

"It's possible to have an impact if [the energy transition strategy, -ed.] is executed correctly, and this is where one needs to have a common sense approach about the portfolio holdings and what one wants to achieve with the investment mandate."

Green-themed equity funds soar as fossil volatility wrenches investors' guts

BNP AM's new Earth fund beats annual return target in less than three months

Green team's new Energy Transition fund strategy rakes in returns off global sustainability