Column: A new allocation paradigm on the horizon as megatrends and helicopter money make inflationary times come closer

Let’s begin with the main conclusions:

- Our understanding and forecasting of inflationary processes and, related to that, of bond yields are extremely poor, so bold forecasts of future inflation and bond yields should be taken with a pinch of humility.

- That said, there are strong arguments that we are leaving a long disinflationary phase and entering a more inflationary paradigm.

- The timing and strength of this change is highly uncertain, but there’s a more than a non-ignorable risk that it could become a theme already this year, most likely in the US, but much depends in the short term on Covid-19, which has a deflationary impact on our economies.

- If we are in the phase of a paradigm shift then the assets that will thrive going forward will be much different than the ones that has been thriving in the “lowflationary” environment of recent decades.

- Also, correlations would change significantly, and the traditional 60/40-portfolio will deliver poor returns.

Poor forecasting skills

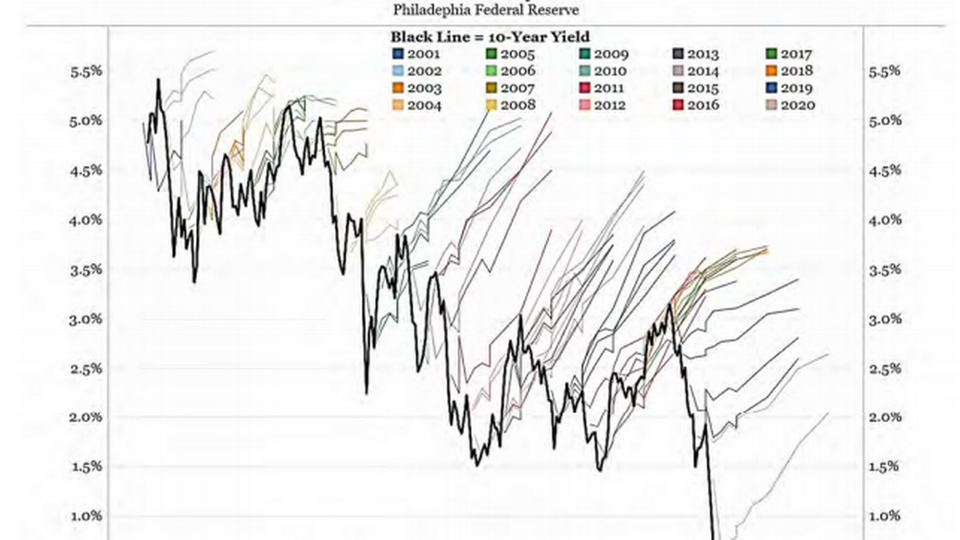

Economists and investors have historically been extremely poor at understanding inflationary processes and thus forecast the direction of bond yields correctly.

From the end of WW2 until 1980 inflation and bond yields were systematically underestimated - and vice versa since 1980 up and until today. In total, almost 80 years of poor forecasting with negative real returns on most government bonds. Studies confirm our poor forecasting skills like the one in the chart from The Federal Reserve in the US below.

Our poor forecasting skills are good to keep in mind before making too bold forecast statements about future inflation and bond yields. A pinch of humility seems warranted.

Mega-trends: From deflationary to a more mixed picture

Looking at mega-trends of importance for inflation, analysts typically rank the following as the most important of which several are in the process of changing their impact:

- Demographics: Is clearly changing from a deflationary to an inflationary force going forward. First, the global work force has more than doubled since the 1980’ties, - - but is now shrinking. Secondly, societies are now aging at an accelerating pace and academic analysis – see for example Goodhart & Pradhan and Juselius and Elod – clearly suggests, that aging is inflationary.

- Globalization: This case is less clear cut as demographics, but overall seems to also change from a clearly deflationary to an inflationary force. First, protectionism is on the rise globally, it will not change with a new president in the US, the China-US dispute and their technological arms race will continue. Corporations are changing their supply line focus from efficiency and “Just-in-Time” to resilient and making them shorter and more local, which drives up costs.

- China: Is also changing from a clearly deflationary to slightly inflationary impact. The work force has peaked the economy is aging rapidly with a doubling of 55-60 year old’s to almost 500 million in the next 20 years, the economy is changing towards being driven more by private consumption and services than cheap exports and fixed investments. IDOR – Incremental Debt Output Ratio, a measure of growth return per unit of debt added to the economy – is also falling rapidly. On top of that the currency is strengthening versus a weak dollar making Chinese and Asian products in general more expensive.

- Global debt wave: We are in the midst of the fifth global debt wave with global debt ratios reaching record high levels, according to the World Bank. The effect of this is uncertain, but probably mostly deflationary.

- Technology: This is supposed to be a highly deflationary force, but its very uncertain if that will come to fruition in the coming years. Tech-optimists and proponents of the Industry 4.0 thinking from World Economic Forum and Singularity University etc. suggest that we are entering a phase of rapidly accelerating technological advances (robots, AI, VR, AR, self-driving cars, 3D printing etc.) and thus higher productivity growth. However, productivity growth has declined in recent decades to historic lows suggesting something else is holding back or offsetting the productive use of new technology. Pessimists suggest we are overestimating the productive effect of these newer flashy technologies relative to previous more low-key advances like sewerage, the fridge or that inventions like the smartphone are distracting us and thus lowering productivity.

The above is some of the main mega-trends, but by far an exhaustive list of bigger trends with an impact on future inflation. But bottom line is that several mega-trends have changed impact from being deflationary to inflationary. Not least the effect of technology going forward is highly uncertain, though.

The Zeitgeist and economic policy: Highly inflationary

In the Western world, neo-liberal capitalism has been abandoned and instead we have entered a new phase of capitalism with more focus on lowering inequality improve worker’s rights relative to return on capital, and bigger government of fear of populism and to tackle global warming. Populations are currently also more accepting of public debt than historically. Finally, the macroeconomic consensus is clearly shifting towards more forceful and expansionary use of fiscal and monetary policy.

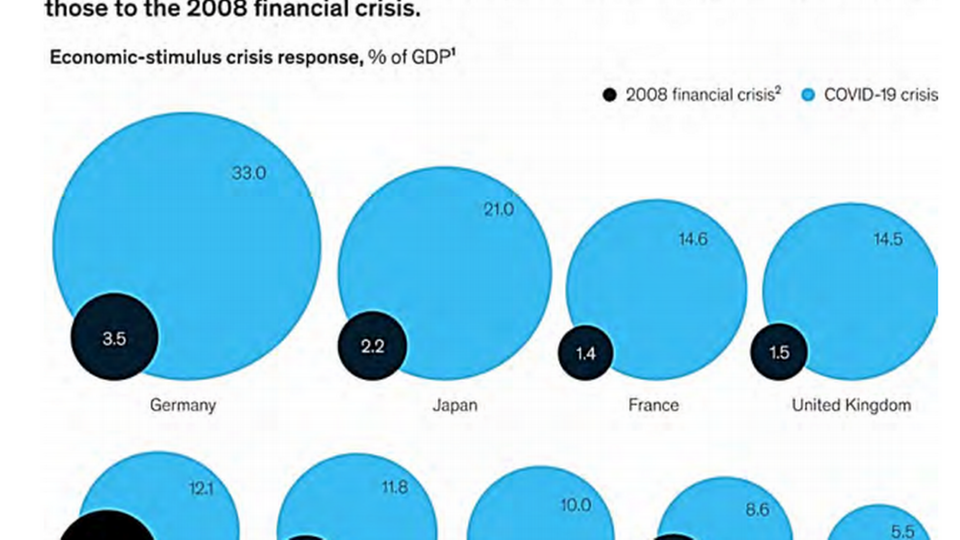

The above is a highly inflationary change relative to previous decades. The economic stimulus response to the Covid-19 crisis by far outsize those to the 2008 Global financial crisis, according to McKinsey (see chart below). Money supplies and central bank balance sheet expansions have also far outstripped those in 2008 and central banks signal that they will keep the money in the economic system for several more years.

The current inflationary picture: Some price pressures in the US, muted elsewhere

Current inflation indicators paint a picture of muted inflationary pressures in most regions with consumer price inflation at 0-1½ percent, highest in the US, lower in China, Europe and Japan. Measures of output gaps suggest inflation will not be an issue for the next 2-3 years at least, however, such measures are highly uncertain and prone to significant revisions.

There are some global pipeline pressures, though, from rapidly rising commodity prices like oil, agriculture and metals and higher transportation costs. Property markets are booming, and both the building and construction business and the technology sectors lack skilled workers despite the covid-19 lockdown-hit economies.

Household incomes are in many countries higher now than prior to the -pandemic hit a year ago because of the huge stimulus packages.Savings are swelling and pent-up-demand for lots of especially different services – holidays, cinemas, theater, restaurants - are gargantuan and could push up service price inflation when the economies have reopened.

Still, more companies, especially in the US, say cost pressures are rising and that price hikes now are being passed on to customers. The ISM prices paid index has risen and is at a level that suggests US inflation could reach 3-4 percent soon. The issue is whether this is temporary or not. So far, wage pressures remain muted suggesting the price pressures are temporary but risks of higher inflation already this year seem not to be ignored.

Investment implications on bonds, equities and alternative investments

The above analysis suggests that the risk of a transfer from a “lowflationary” to a more “inflationary” regime seems non- negligible for asset managers, but that the timing and strength is very uncertain. When we talk about an inflationary regime, we think of inflation running at least 3-4 percent for an extended period.

Should inflation rise to only 1½-3 percent, we would characterize it as reflation, which historically has been a very positive scenario for risky assets. In contrast, a true inflationary regime is more troublesome. delivering -8 percent returns on equities, -4,5 percent for bonds, -4 to -5½ percent for corporate bonds, but +1 percent for alternative risk premia according to an analysis by MAN group. The regime is also very seldom (only 13 percent of the time since 1926) and last seen in the late 1970’ties, so few of today's investors have experience navigating in such an environment.

Overall:

- The traditional 60/40-portfolio will deliver very poor returns

- Stock-bond correlation rising significantly from negative to positive territory

Equities:

- Negative returns overall, huge valuation contraction

- Value and Momentum factors thrives, Growth, Stability and Quality not

- Cyclical sectors perform better than Defensive

- Equity markets with a heavy weight in the above winners like Norway, Sweden and Latin America doing better than US, Denmark, Switzerland. Non-US better than US

Bonds:

- Few bonds would be of value in this scenario for the long-term investor

- Inflation-linked bonds should outperform nominal bonds, but due to the current negative interest rates on linkers, both categories will deliver negative returns

- SEK and NOK-bonds doing better than DKK-bonds due to more pro-cyclical/pro-inflationary currencies

- Selected EM-bonds would be some of the only to deliver positive real returns, not least commodity producing countries

Alternative:

- Broad-based commodity exposure would perform strongly, precious metals, though, only if negative real interest rates persist

- Infrastructure investments would in general perform poorly as it correlates negatively with bond yields and contract based typically more poorly than market based, but big individual differences depending on the exact contracts

- Property investments are often a good inflation-hedge except when valuation is high (as now), but also exhibit huge individual differences, with retail exhibiting the best historical inflation hedge and Offices the least according to analysis by CBRE

- ILS/CAT-bonds should be able to deliver positive real returns

Danish Wall Street economist: The hunt for yield will carry on - but watch out for inflation

Silver spikes as retail investors swarm their biggest target yet