Credit market throws weight behind shareholder ESG activism

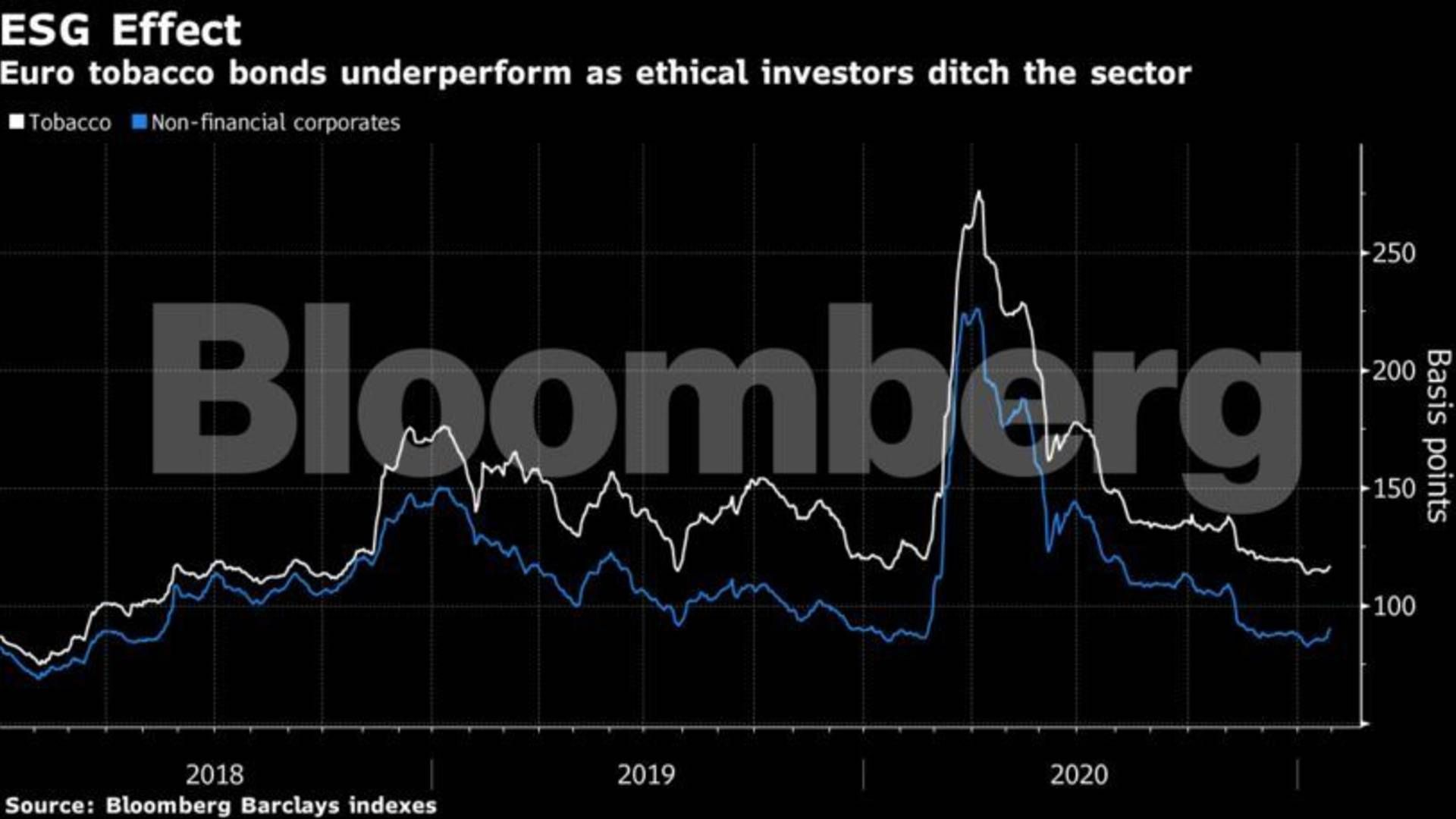

Participants in the USD 40 trillion global credit market are using roadshows, industry groups and divestments to press issuers over environmental, social and governance concerns, such as pollution or management oversight. That extra focus and financial muscle is amplifying efforts in equity markets, the traditional front-line of investor activism.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.