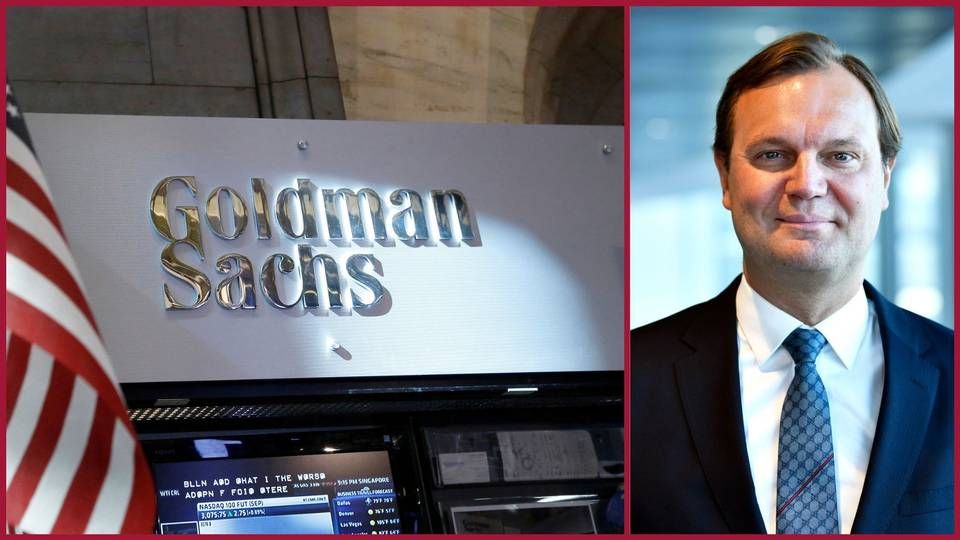

Goldman Sachs says bankers beat algorithms when it comes to ESG

In Copenhagen, where Goldman is expanding to grab more of the cash-rich Nordic asset management market, smart environmental, social and governance investing calls are key to winning business. And as Nordic countries blaze a trail in all things ESG, whatever works in the region is likely to become a template for other parts of the world.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Goldman Sachs AM Nordic integration plan takes a step ahead

For subscribers

Sustainable funds power ahead and attract billions in inflow

For subscribers