New sustainability quant manager makes Stockholm key in global conquest: "ESG leadership coming from the Nordic region is really phenomenal"

When Chicago-based V-Square Quantitative Management (V-Square) announced that its distribution would operate out of Stockholm with the hiring of Erik Norland as head of distribution, it was a commitment suggesting that the Nordic region will play a big role in the newly-established asset manager's development.

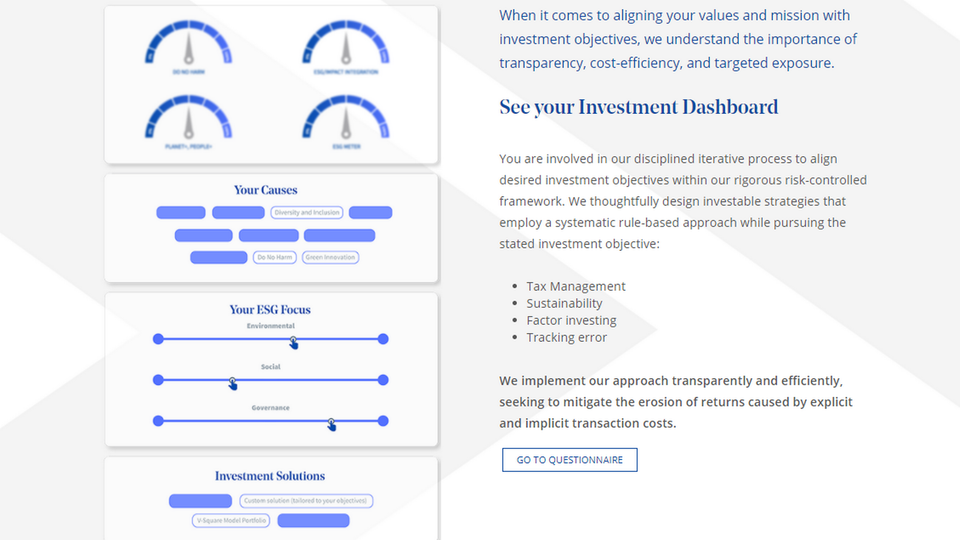

Founded in 2020, V-Square's investment engine uses sustainability big data to develop investment solutions within the growing field of passive products with intended ESG customization. These are delivered in rules-based factor investing strategies. In general, customized index products with personalized sustainability filters are very much in style in the institutional community.

V-Square's first live strategies, which are implemented via separately managed accounts, are within listed equities, but requests within fixed income have started to pick up. The starting point for any conversation with a potential client is a value based questionnaire, which aims to find out what the prospects care about.

"As a long-term practitioner in the ESG space, the hardest question for a prospect to answer is their expectations from a performance standpoint and ESG outcomes, because how they define success can be unique," V-Square President and co-founder Mamadou-Abou Sarr explains in an interview with AMWatch, and continues:

"Some investors focus on outperformance versus a benchmark, and others focus on specific ESG outcomes. It depends on what you want to achieve."

What tends to matter most for investors?

"The most pressing matters for Nordic prospects are fees, low carbon exposure, following global norms, and thematic investing, based on what I have seen from the questionnaire responses," Sarr says.

According to a V-Square firm brochure, fees for separately managed accounts may be up to 1.25 percent per annum depending on complexity. Sarr, however, states this figure represents the upper limit given the brochure is a regulatory paper.

You mentioned fees are important to potential investors. What do you consider a competitive price for a beta strategy with an ESG overlay?

"An important component of the pricing is actually the cost of data. The fee pressure we see our clients face doesn't always reconcile with the cost of vital ESG data. We do consider our fees to be competitive and I am acutely aware of the pricing in the Nordic region along with the dynamics for passive and enhanced products as I was responsible for pricing ESG strategies in the Nordic region at my prior firm, Northern Trust Asset Management," he says.

Unfazed by data costs

As a quantitative manager, data is fuel to the investment engine. Across the investment landscape, asset owners and managers alike face increasing difficulty in choosing among companies that provide ESG data – and how to compare, analyze and interpret the data once they've got it.

According to Sarr, V-Square uses several big data providers in its models.

"Because I led the charge of vetting data providers at Northern Trust, I have built a strong relationship with many of them," Sarr explains.

"We have developed an open architecture platform with access to data from MSCI, Bloomberg, ISS and more data brokers," he says.

UK asset manager Schroders' annual institutional investor survey from 2021 showed that costs associated with investing sustainably is a growing concern for global investors, as reported by AMWatch. In fact, more than a third of the 750 investors who participated in the survey highlighted costs as a main challenge.

Building a new team at V-Square with Erik Norland as the most recent hiring, the obvious question is whether acquiring data from so many providers is perhaps too expensive as a solution:

"On the quant side, the major trend in the ESG space is data, data and more data. Even though ESG data is an important cost, it's the best way for us, as a specialized manager, to develop our portfolio and help asset owners understand the ESG risks and opportunities," Sarr says.

First mandates

V-Square started with two strategies: a low carbon and a US large cap ESG best-in-class at its inception, and Sarr says that more strategies are on the way.

"As we scale our capabilities, we launched an EAFE ESG Leaders strategy with more strategies in the pipeline as we support investors to meet their ESG goals," he says and continues:

"We are getting traction with mandates from intermediary platforms, others are from foundations and there are more clients along the way. The feedback from the market is that even though ESG has grown so much in popularity, a lot of clients are still increasingly asking for customized solutions."

According to the firm brochure, V-Square started its journey with USD 3,340,000 in regulatory assets, and while Sarr says that assets have grown substantially since inception, the updated AUM figure won't be disclosed until later this year.

Stockholm trip this month

Like Sarr, the company's new head of distribution has also worked at Northern Trust Asset Management, where he served as the firm's head of Nordic region. Norland and Sarr often traveled together to meet investors, and they expect to reunite in Stockholm in August, this time as two of V-Square leaders.

"We look forward to leading innovation and the integration of ESG data in the Nordics and becoming a valued partner to institutional investors in the region," Sarr says, and continues:

"With our head of distribution based in Stockholm we have a strong presence. We are a global firm and Erik brings talent to the Nordic region that has global leadership within ESG. His expertise brings a local view to innovation for our investors."

As a new manager, can you be competitive in the region?

"We are as competitive as the local managers. My sense was that we needed to be local – we wanted to be active in the Nordic region though the strength of local presence in the region. Erik's global role, strengthens our platform because the ESG leadership coming from the Nordic region is really phenomenal," Sarr says.