Why hedge-fund bulls and bears are crowding into the same tech stocks

A dozen or so technology firms appeared on Morgan Stanley's list of the 50 "crowded longs" at the end of last month. The same companies, whose names the bank didn't disclose, also made the prime brokerage's list of "crowded shorts".

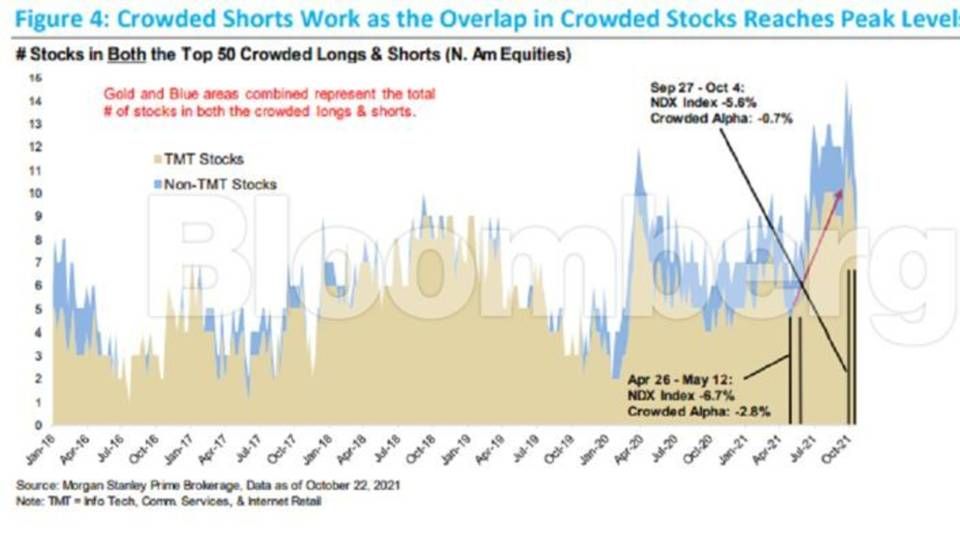

That's an extreme overlap not seen since 2010 and illustrates the growing divergence in opinions on where the market’s one-time darlings will go from here.

The split also speaks to the challenge of picking the right stocks at a time when the economic outlook remains murky and the Federal Reserve is considering rolling back its pandemic support. While tech innovations point to better growth prospects in the long run, stretched valuations put the industry in the crosshairs of a raging debate about inflation and interest rates.

"Either growth is scarce and I should own growth, which is the long side of the trade," said Benjamin Dunn, president at Alpha Theory Advisors LLC.

"Or growth is not so scarce, inflation is going higher, and the Fed is going to have to act more aggressively. Then I don't want that exposure, and so I might want to be short."

The divergence came right before the start of the third-quarter earnings season.

Supply-chain disruptions and headwinds from Apple's new limits on consumer data collection hurt profits at companies like Snap and Twitter. Meanwhile, Microsoft Corp's cloud-based software helped drive robust sales and profit growth, and Google's parent Alphabet reported revenue that topped Wall Street estimates.

It's possible that some money managers have realized there is trouble brewing, while others are willing to look past one or two bad quarters, said Dunn.

Morgan Stanley noted that tech shares have seen the biggest increase in short sales among major industries this year accounting for about half of their clients' total additions. Partly driving the bearish tilt was the manager's failure to deliver on the long side.

The firm also said that the extreme overlap in the crowded longs and shorts is a sign of diversification that helped the hedge-fund industry fare better during the latest stock rout.

The alpha, or above-market return, from the top-crowding stocks was a loss of less than 1 percent in the week through Oct. 4. That compares with a drop of almost 3 percent over a similar period of selloff in May.

NAM expects net sales to continue due to long and strong ESG history

Fund managers brace for correction as greenwash rules go global

Related articles

ATP's managed assets maintained growth in Q3

For subscribers