Intech believes comeback is imminent with renewed interest after challenging years

In 1987, financial mathematician Robert Fernholz founded the quantitative asset manager Intech, which, simply put, seeks to generate excess returns by combining mathematics and systematic portfolio rebalancing. The idea is to harness returns from the volatility in stock price fluctuations.

For a manager that uses volatility to generate trading profits, the past decade with high returns and low volatility has been difficult. In this environment, investors have favoured cheap index exposures over quantitative strategies, and Intech has experienced a capital exodus.

The figures tell the story: By September 2021, Intech's assets under management totaled USD 39bn (EUR 34.2bn) globally, with 132 institutional clients on five continents. In contrast, the corresponding figure stood at USD 42bn at the end of 2020, USD 45.2bn at the end of 2019 and USD 49.9bn at the end of 2017.

Intech's parent company Janus Henderson Investors published these figures in its annual accounting reports, which highlight an investor preference for passive management in equities as the root cause of the drop in AUM.

Intech, however, believes the tide is turning.

In recent months, Intech's President for International Division David Schofield and Head of Nordics at Janus Henderson Investors, Preben Oeye, have traveled across the region to engage with existing and potential investors – stopping briefly to make a keynote speech at the Norwegian Association for Quantitative Finance's seminar Advances in Portfolio Management under Uncertainty.

The duo says investors want to meet with them for two reasons: Interest in reducing risk in parts of their equity portfolio and different approaches to de-risking.

"We have seen renewed interest and some new opportunities in the Nordics as many have been reviewing their overall portfolios towards year end, and with volatility back in the markets this seems to have spurred them to consider the risk and downside protection of their portfolios," Oeye says.

"Several institutional investors are becoming increasingly concerned about the long-running bull market with strong returns and low volatility," Schofield adds.

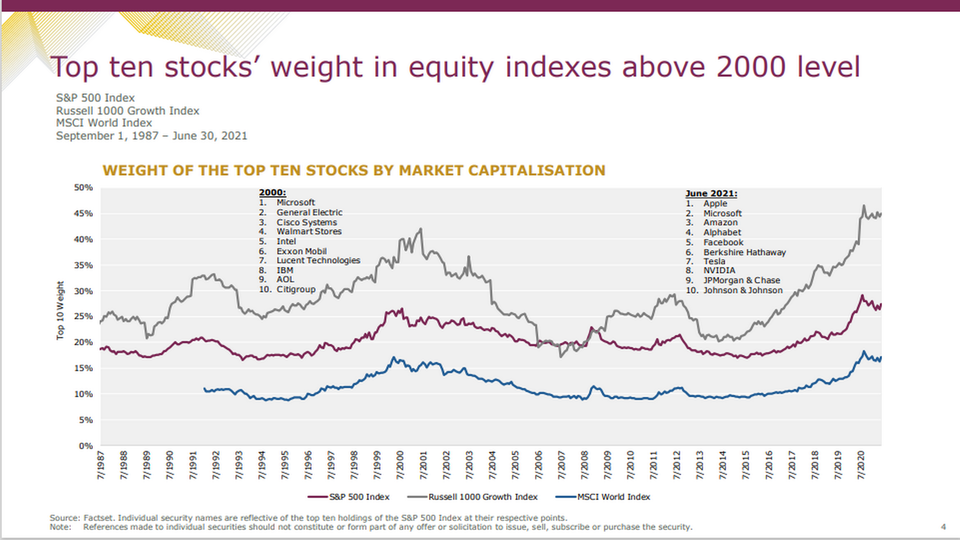

Schofield provides a graph depicting that the development in mega stocks has led to a substantial concentration of capital. Intech states that the top-10 stocks' weight in equity indexes are above the levels of year 2000 during the dot-com crash.

The increased concentration of capital is a key reason to why people have started to rediscover Intech, Schofield claims.

"Investors have come to realize that the bull market can't go on forever and it will start to reverse at some point. You don't want to be left with all of your eggs in one basket when that happens," he says, adding that he therefore expects interest in low volatility and diversified strategies to pick up.

The first evidence of this has already started to appear in the first week of 2022, where tech shares were sold off as the Federal Reserve confirmed its more hawkish market view in order to tame inflation.

A look inside Janus Henderson Investors' annual report shows that as well as the drop in AUM, performance has halted.

The 2020 Janus Henderson Investors Report states that 69 percent, 24 percent and 16 percent of Intech's assets under management have outperfomed the benchmark on a respective 1, 3 and 5-year basis. In contrast, the figures are above 90 percent in the categories fixed income, multi-asset and alternatives.

Schofield acknowledges that some of the firm's strategies have been lagging behind their benchmark.

"There are a couple of reasons for that. A lot of our defensive portfolios are designed to be less volatile than the market and provide downside protection. This means it doesn't move as much as the market moves. When the market goes up very sharply, as it has been doing, you would expect those portfolios to be behind the market," he says, and continues:

"The concentration of capital has been a headwind for diversifying strategies. It doesn't mean that you always underperform," he says.

Schofield highlights that Intech's performance shouldn't be assessed on a few years or even a decade.

"Our investment process is based on reweighting stocks in the index to more a diversified combination and then rebalancing, and then the act of rebalancing generates alpha. That effect is better if there are slightly more volatile stocks in the portfolio. Think of rebalancing as generating a trading profit - you have a target weight for a stock and the stock moves away from your target weight because of its market movements," he explains.

While many other quantitative investment strategies data mine across an ocean of financial, ESG and alternative data, Intech uses mathematics.

"I think the reason we are able to differentiate ourselves is that our process has always been focused on the whole portfolio. We're not looking at individual stock considerations, but at solutions for the entire portfolio, which is a helpful perspective to have, because you don't get caught up individual stock issues," Schofield says.

According to Oeye, Nordic investors haven't abandoned Intech's strategies unlike their global counterparts.

"Nordic investors use Intech's solutions as building blocks in their portfolios, and they use Intech alongside passive exposures. We have clients all across the region, but Intech seems to particularly resonate with Danish investors where many investors have a background in mathematics," Oeye says.

The Danish pension fund PKA had invested in Intech's Low risk Equities strategy, according to PKA's 2020 annual report, which also shows several mandates at other systematic investment firms, including AQR Capital Management and Acadian.

"The interest is not because the sudden increase in volatility makes Intech interesting again, it has always been there, but it has now started to come from a new type of clients," Oeye says.

These are foundations, endowments and other tier 2 institutions. At the moment, several pension investors use Intech as a diversifying equity exposure, he says.

Oeye explains that the investors he and Schofield have met want tailor-made mandates and that the investors that have been sitting on broad and cheap passive exposures are now starting to question whether it is time to increase exposure to strategies with downside protection.

"Institutional investors like diversified sources of alpha. They like to combine managers that are uncorrelated. Intech is a prime example of that, as our alpha is uncorrelated with the excess return of other managers," Oeye says, and continues: .

"In Norway, we have a new potential, as investors want to replace 50-75 percent of their passive holding potentially with Intech to get the downside protection, but we're are just waiting for the investor to make a final decision on it."

Institutional investors underestimate risk, warns AQR

Janus Henderson in double fund launch

Too many active managers spoil the return, quant wizardry shows

Related articles

Janus Henderson in double fund launch

For subscribers

Institutional investors underestimate risk, warns AQR

For subscribers