Passive investors need to think twice about their approach

Over the past decade we have seen a huge amount of money pour into passive investments both globally and here in the Nordics, and both within equities and fixed income. There are well-known reasons behind this trillion-dollar passive tsunami: Cost savings, the poor performance of active managers and high market returns.

However, with 2022 around the corner, investors especially investors in passive investment instruments face some huge challenges, including very low future returns. The extremely concentrated returns and valuation dispersion the last couple of years almost guarantee lousy returns on passive investments for the next decade.

Firstly, valuation of equities, bonds, credit and most alternative investments are at a record high, and the expected returns for the next 10-15 years look really dismal. Most bonds are currently trading at zero or even negative real yields and global equities are trading at very high multiples that have historically been followed by very low long-term returns.

Therefore, if you are investing in passive instruments, you will definitely get this very low market return, while active investors can be lucky (or skilled) and receive higher returns.

How low will we go?

Well, at Jentzen & Partners, we systematically collect long-term return expectations from more than two dozen international investment houses. The average this gives us is not too far removed from the ones used by the Danish financial sector for long-term projections and those gathered by business school professor Jesper Rangvid from a small number of international finance houses.

The latest numbers are shown in the table below, and they don't appear to be that dismal after all. The problem is, they are based on forecasts stemming from investment firms with a clear interest in higher return expectations and are thus biased towards optimism.

More neutral observers and basic modeling of current valuations against subsequent 10-year returns deliver much lower returns, especially on equities (and thus also private equity), totaling 3-5 percentage points.

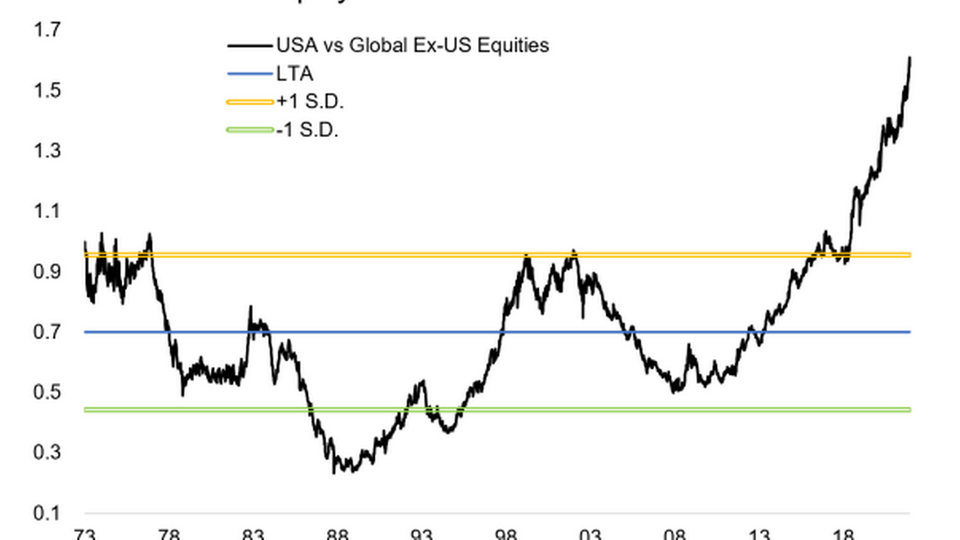

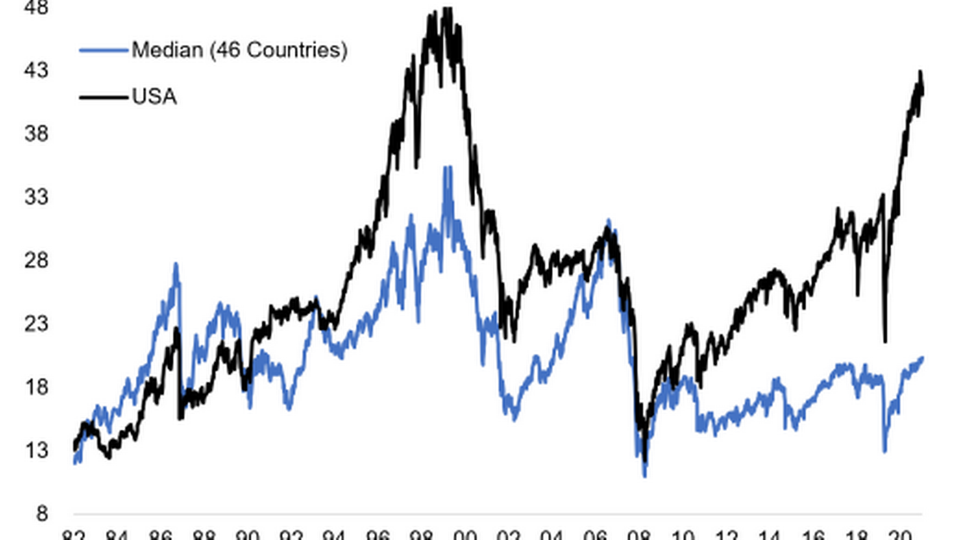

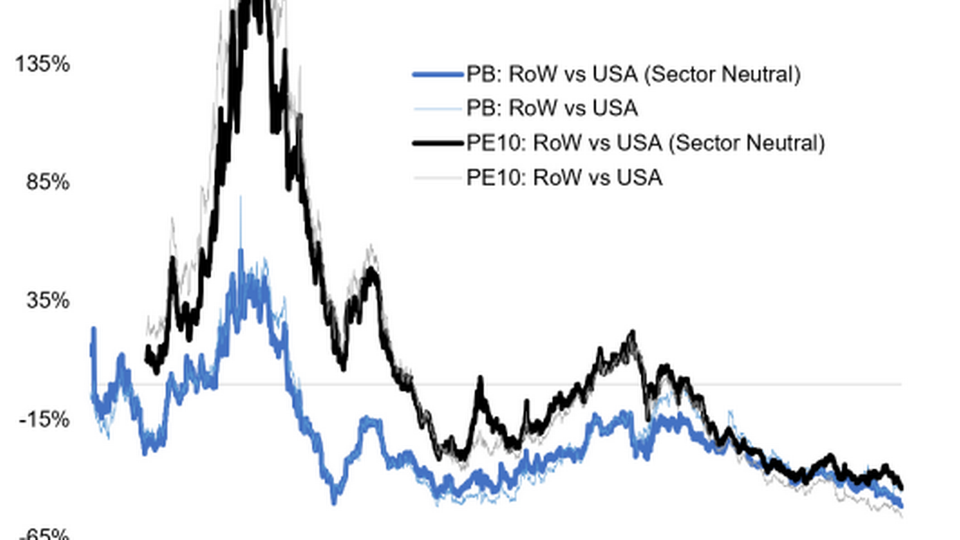

The problems for passive investors are amplified by the extremely concentrated returns and valuation dispersion we have witnessed the last couple of years within the equity space. US equities have outperformed Rest of World massively. The same goes for Quality and Growth factors and not least the US tech sector and the biggest names relative to other factors, styles and sectors.

Some of this outperformance is well founded in superior earnings growth and margins and stability in earnings. However, the aforementioned regions, factors and sectors are now trading at historically high premiums compared to the rest of the equity market, premiums last seen or even surpassing the ones seen in 1999/2000 just before the IT-bubble burst, which were followed by a decade of woeful returns.

This can be seen from the following regional charts:

'

Huge valuation dispersions

Furthermore, a historic number of stocks, especially from the US, are currently trading at price-to-sales ratios of above 10x or 20x (although a big correction is underway) and the five biggest US tech/consumer stocks, Apple, Microsoft, Amazon, Google (Alphabet) and Facebook (Meta) have seen a significant expansion and now trade at almost 7x price-to-sales on average, far above their historic average.

Such high price-to-sales multiples, huge valuation dispersions and concentration of returns is almost a guarantee that ordinary passive global equity market indices will deliver lousy returns in the coming 10-15 years.

Will the passive tsunami lose momentum?

None of us knows when the period of low returns will begin and how low the returns will actually get over the coming decade. But going forward, very low returns are likely to create headwinds for passive investors and independent advisors that are solely relying on passive instruments.

Yes, they will save their clients some basispoints in costs, but that gain is in great danger of paling into insignificance compared to the lousy returns they will deliver to their clients.

On the other hand, a decade of low returns could generate some tailwind for active managers with a proven track record. Active managers without a solid alpha generation capability, though, will find themselves caught in the crossfire.

Industriens Pension picks two managers for new global equity mandates

Swedish Pensions Agency claims Nordea has breached fund agreement