After historic fund launch: Summa Equity turns into a global impact player

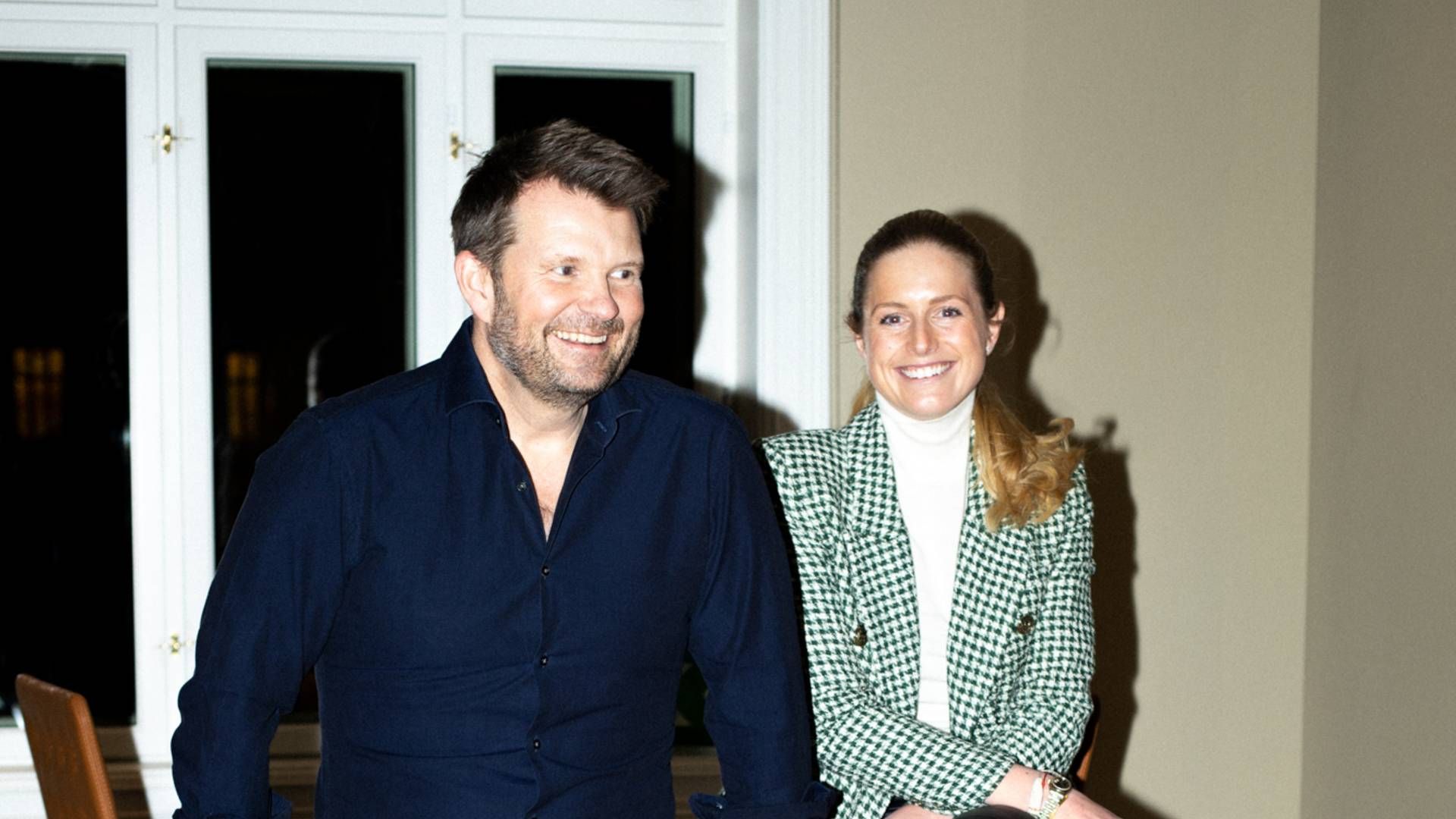

Through last week's launch of Europe's single largest impact fund, Summa Equity has seen its investment universe expand and become a more global organization. Managing Partner Reynir Indahl is confident that the firm can successfully make the leap required to turn into a global player.

Last week, Nordic private equity manager Summa Equity announced that it had raised a whopping EUR 2.3bn in four months for its third impact fund – making it Europe's largest impact fund to date.

Already a subscriber?Log in here

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Summa Equity raises the largest European impact fund to date

For subscribers