NAM has Europe's largest Article 9 fund

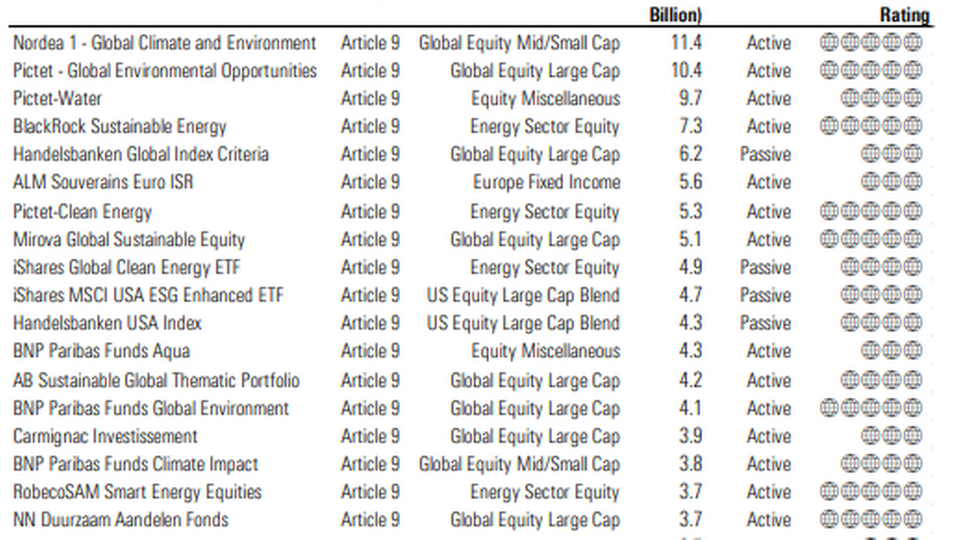

Nordea Asset Management’s blockbuster fund Global Climate and Environment is Europe’s largest Article 9 fund, according to a new analysis from investment consultancy Morningstar.

The analysis states that the fund’s asset base has reached EUR 11.4bn, and the fund’s inflow in the fourth quarter was more than EUR 400m. Nordea has previously soft-closed the fund because fund doubled in size over the course of 12 months.

The popular fund is managed by Thomas Sørensen and Henning Padberg from Nordea Asset Management’s fundamental equity team, who invest in companies that develop climate solutions, as the fund’s name suggests.

The 20 largest Article 9 funds

Shrinking market shares

It’s been almost a year since the European Union introduced its Sustainable Finance Disclosure Regulation, which has led most asset managers to restructure their fund offerings, as since 10 March 2021, funds available for sale in the EU have been classified by their manager as Article 6, 8, or 9, depending on their sustainability objectives.

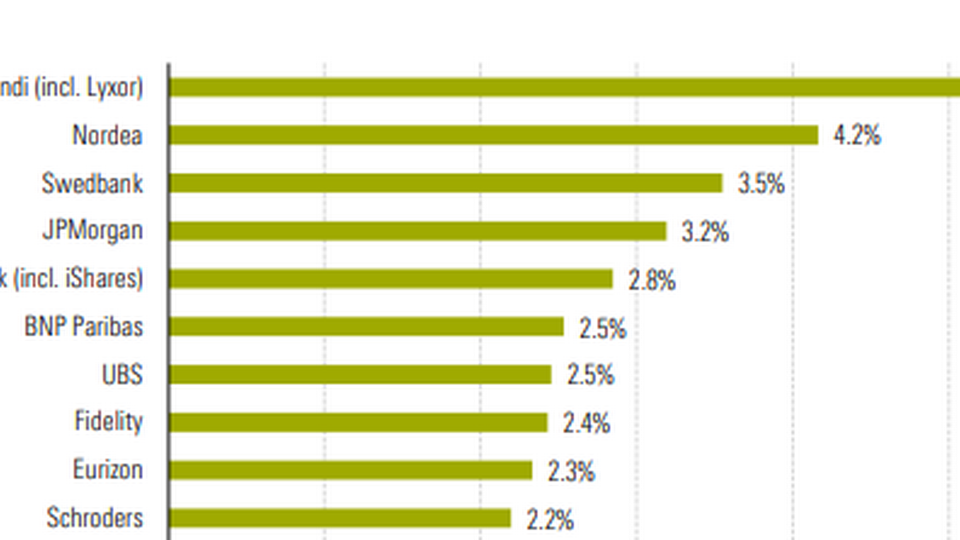

The trio topping the league table in terms of market shares with assets in Article 8 and Article 9 funds are Amundi, Nordea, and Swedbank.

This is unchanged compared with the third quarter, albeit with slightly lower market shares of 5.5 percent, 4.2 percent, and 3.5 percent, down from 6.2 percent, 4.7 percent, and 3.9 percent, respectively, as competition heats up. Assets in Article 8 and Article 9 funds reached EUR 4.05trn at the end of December 2021, representing 42.4 percent of all funds sold in the EU.

In the fourth quarter, Article 8 and Article 9 funds captured 64 percent of EU fund inflows, or EUR 81.4 billion.

Top 10 asset manager ranking by Article 8 and Article 9 fund assets

Active funds continue to largely dominate the SFDR Article 8 and Article 9 landscape. However, the market share of passive funds increased slightly throughout the year, ending at 9 percent and 17.4 percent, respectively.

Combined, passive funds account for 9.7 percent of overall Article 8 and Article 9 fund assets, less than half of the 20.3 percent market share for passive funds in the overall European fund universe.

According to Hortense Bioy, Global Director of Sustainability Research, the increased market share of Article 8 and Article 9 funds has been driven by growing investor interest in ESG and sustainability issues, especially climate change, and the expanding range of options available.

”We expect this trend to continue this year as ESG becomes the norm and more funds are classified as Article 8 or Article 9. The MiFID II amendment coming into effect in August will prompt more retail flows into sustainable funds as financial advisers will be required to ask clients about their sustainability preferences,” Bioy says.

Nordea AM to cap flagship fund’s institutional inflow despite soft close status

Related articles

Nordea Asset Management to soft-close popular fund

For subscribers