Managers rewrite model portfolio to generate real returns in inflationary environment

High inflation rates means retail investors need to look beyond the 60/40 portfolio to generate real returns.

by lene andersen, translated by catherine brett

Goldman Sachs recently abandoned its faithful recipe for a stable growing portfolio. Over the past 100 years, the 60% equities and 40% bonds portfolio has generated an average return of 5%.

Already a subscriber?Log in here

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

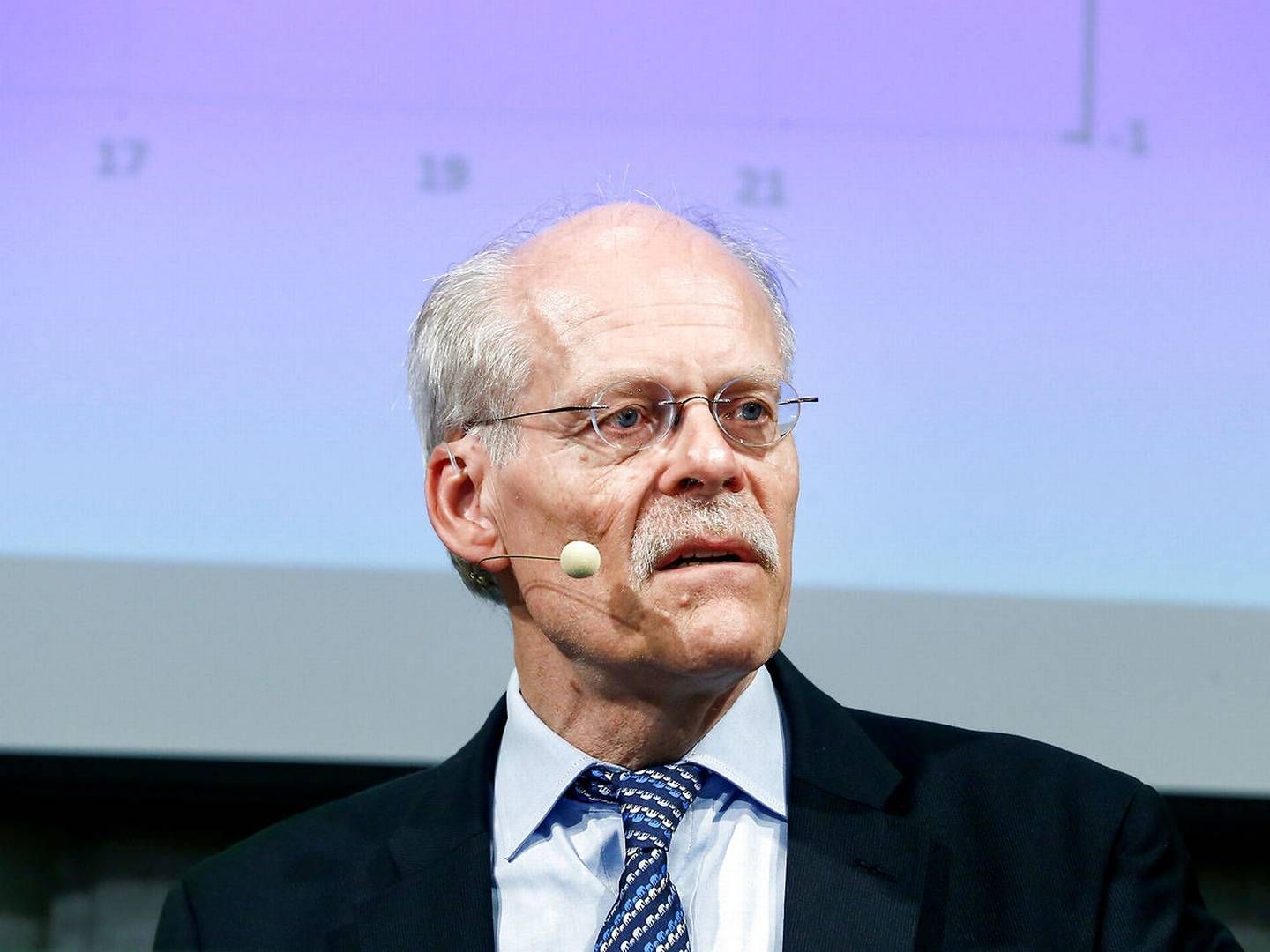

Riksbank Governor leaves door open for string of rate hikes

For subscribers