US manager expands Nordic fund range to seize "opportunity for significant growth"

US asset manager Dimensional Fund Advisors is seeing a growing demand from Nordic investors and has thus chosen to expand its fund range in Finland, Norway, and Sweden.

“We see the Nordics as an opportunity for significant growth and, based on talking to investors in the Nordics, it became clear to us that there was a need to broaden the options of funds registered in Sweden, Finland, and Norway,” Mamdouh Medhat, senior researcher and vice president at Dimensional, tells AMWatch.

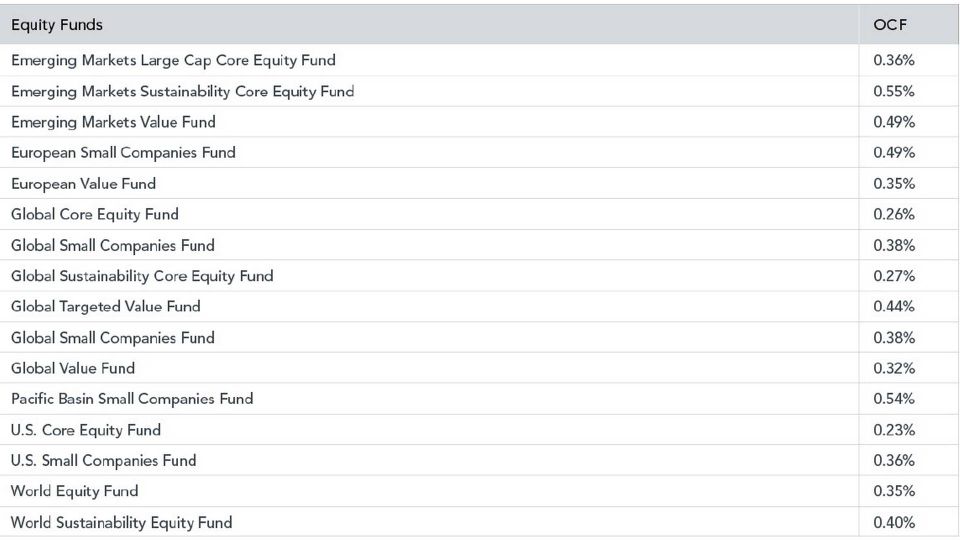

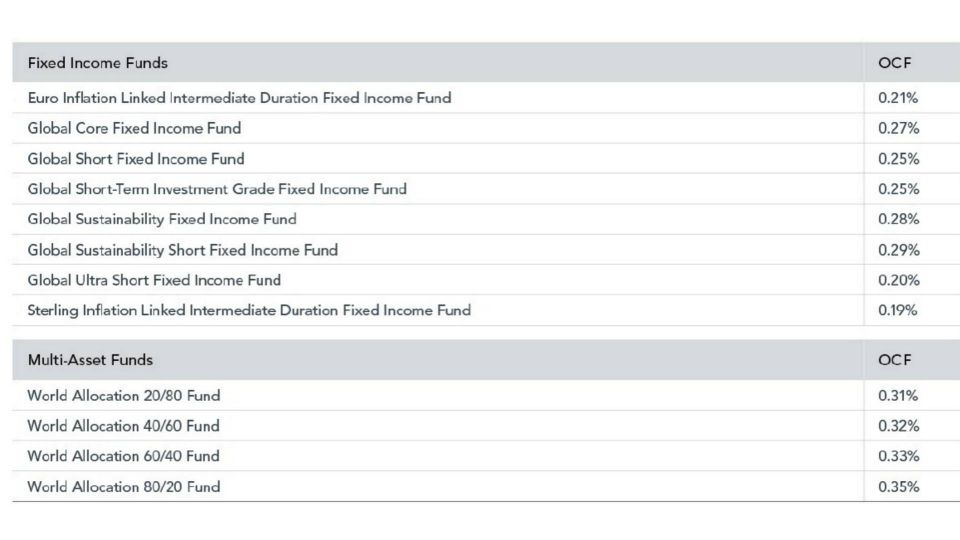

Dimensional’s fund range now consists of 28 different strategies, including global and regional equity funds: Core, value, and small-cap funds. The range also includes fixed-income funds and several multi-asset strategies.

The manager has been dealing with Nordic investors since 2004, served clients through its Amsterdam office since 2010, and has been selling its funds to institutional investors since then. However, to be able to distribute more funds to retail investors through financial advisors and wealth managers in the three countries, the manager needed them to be registered.

Dimensional hasn’t seen the same demand from its Danish clients in the segment and has therefore not yet registered the funds in Denmark.

“By expanding this offering, we are opening the doors to more professional investors in the Nordic region, and hopefully with that seeing substantial growth for the firm as well,” Medhat says.

With an AUM of a little more than USD 3bn in Northern Europe, the manager is, despite the alleged demand, relatively small in the Nordic region. Globally, Dimensional manages more than USD 600bn with a little over USD 50bn in the EMEA region.

Between two extremes

Dimensional’s Nordic push comes at a time when more and more Nordic investors are looking for cheaper and more private assets.

The US manager is known for being a pioneer in systematic investing, also known as quant. Being firm believers of actively managed strategies in the public markets, Dimensional does not exactly tap into that hype.

Nevertheless, Medhat thinks the manager’s systematic and research-based approach, which he describes as “somewhere between the two extremes” of a star manager fund and an index product, will fill a gap in the Nordic market because it has the flexibility of the active and the diversification and low-cost structure of an index strategy.

“It is simply about harvesting premiums, and that’s why we think these are good investment products at any time, but in particular right now in the Nordics,” Medhat says adding that the manager will stick to public markets despite the hype for private assets.

“We have a fairly broad and good understanding of alternatives. But for us, you know, where we really can harness what we do best will be in public markets.”

Boots on the ground

In January, Dimensional expanded its Nordic presence with the relocation of Kevin Hudson-Phillips, a 12-year veteran of Dimensional’s London-based Global Client Group. From the manager’s Amsterdam office, he, alongside his colleagues Dušan van Leeuwen and Richard Feenstra, oversees distribution to the Nordics and Benelux.

In recent years, several international managers have set up offices in the Nordics, and according to AMWatch’s information, more is on its way.

Dimensional has not decided to do so, as the management thinks it can serve Nordic clients just as well from Amsterdam.

“Amsterdam is both convenient, close by, well-served, and you have London, you know, an hour away. But given our focus on the Nordics as a growth region, and our expansion of the funds that are now being registered, we will be continuously reassessing whether we need a physical office in one of the Nordic countries,” Medhat, a Danish national himself, concludes.