AP1: Swedish investors are responsible for weakened currency

The investment strategy of Swedish fund savers has weakened the domestic currency, the CEO of Första AP-fonden (AP1), Kristin Magnusson Bernard, argues in an interview with Swedish news agency TT (Tidningarnas Telegrambyrå).

According to Bernard, the Swedish investors’ huge allocation to foreign investment funds, such as USD-denominated index funds, has helped push the krona to the current record-low exchange rate.

”This is because they buy foreign index funds, which is a combination of buying US stocks and selling kronor at the same time. This flow has simply been greater than the buyers [of kronor] for quite some time. This means that there is a downward pressure on the krona,” Bernard says.

According to figures from the Swedish Investment Fund Association, inflow to global funds constituted SEK 50.6bn (EUR 4.3bn) out of the total SEK 54.6bn (EUR 4.7bn) net inflow to the Swedish fund market this year. Out of the total net inflow to equity funds of SEK 77.4bn (EUR 6.6bn), there was a net inflow to index equity funds of SEK 85.8bn (EUR 7.3bn).

A similar trend was seen last year.

Bernard also says that she doesn’t fully agree with economists saying the Swedish currency is undervalued or that the depreciation is a result of a ”crisis of confidence” in the Swedish economy.

”We tend to look at Swedish weaknesses as the explanation, but I don’t think that’s the main explanation at all,” she says and adds that the rate hikes from the US Central Bank also play a major role.

When announcing the August figures, the Swedish Investment Fund Association’s savings economist Philip Scholtzé said: “The weak krona certainly has an effect when savers continue to buy funds with a US orientation while a long period of inflows to Swedish funds is now replaced by outflows in August.”

Buying kronor

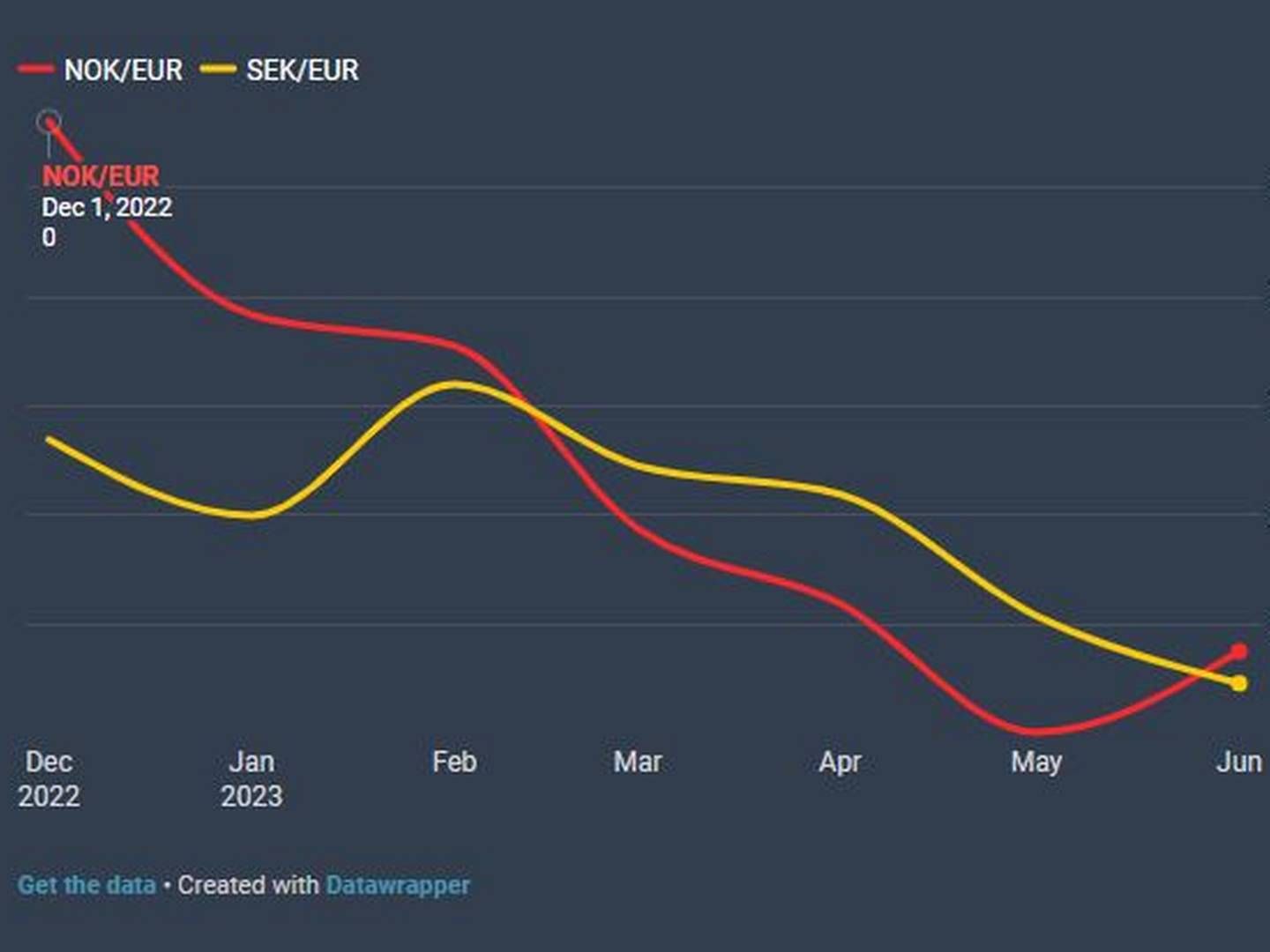

The krona has depreciated 5.7% against the euro this year, and is currently 10-15% weaker than it should be against currencies such as the euro and the dollar, The Governor of the Swedish Central Bank, Erik Thedéen, said at a seminar on Friday after the central bank had announced its selling of SEK 100bn (EUR 8.5bn) worth of EUR and USD.

Since the end of 2021, the Swedish krona has depreciated 13.3% against the euro, and 18.8% against the dollar.

Even though the value of the currency sell-off is equivalent to one-fourth of AP1’s SEK 446bn (EUR 38bn) assets under management, Bernard said she didn’t think the move from the central bank would be enough to strengthen the krona.

”It is not a very large figure compared with the rest of the market,” she tells Swedish business media Affärsvärlden and adds:

”As long as we continue to prefer foreign assets to domestic ones, it will be like selling kronor.”

Thedéen who stressed that the Riksbank does not have a target for the exchange rate told the media that he believes institutional investors such as AP1 will eventually follow in the footsteps of the Swedish Riksbank, and sell euros and dollars.

”When the distance from the fundamental value of the krona becomes so large, it will, over time, lead to more and more investments in Swedish assets,” he says.

Related articles

Weak currency turns investors off Swedish funds

For subscribers