Beslik fund wins Japanese ESG award

Sustainable investment profile Sasja Beslik is making a success of Asia’s first Article 9 fund less than a year after leaving Danish pension company PFA to join SDG Impact Japan.

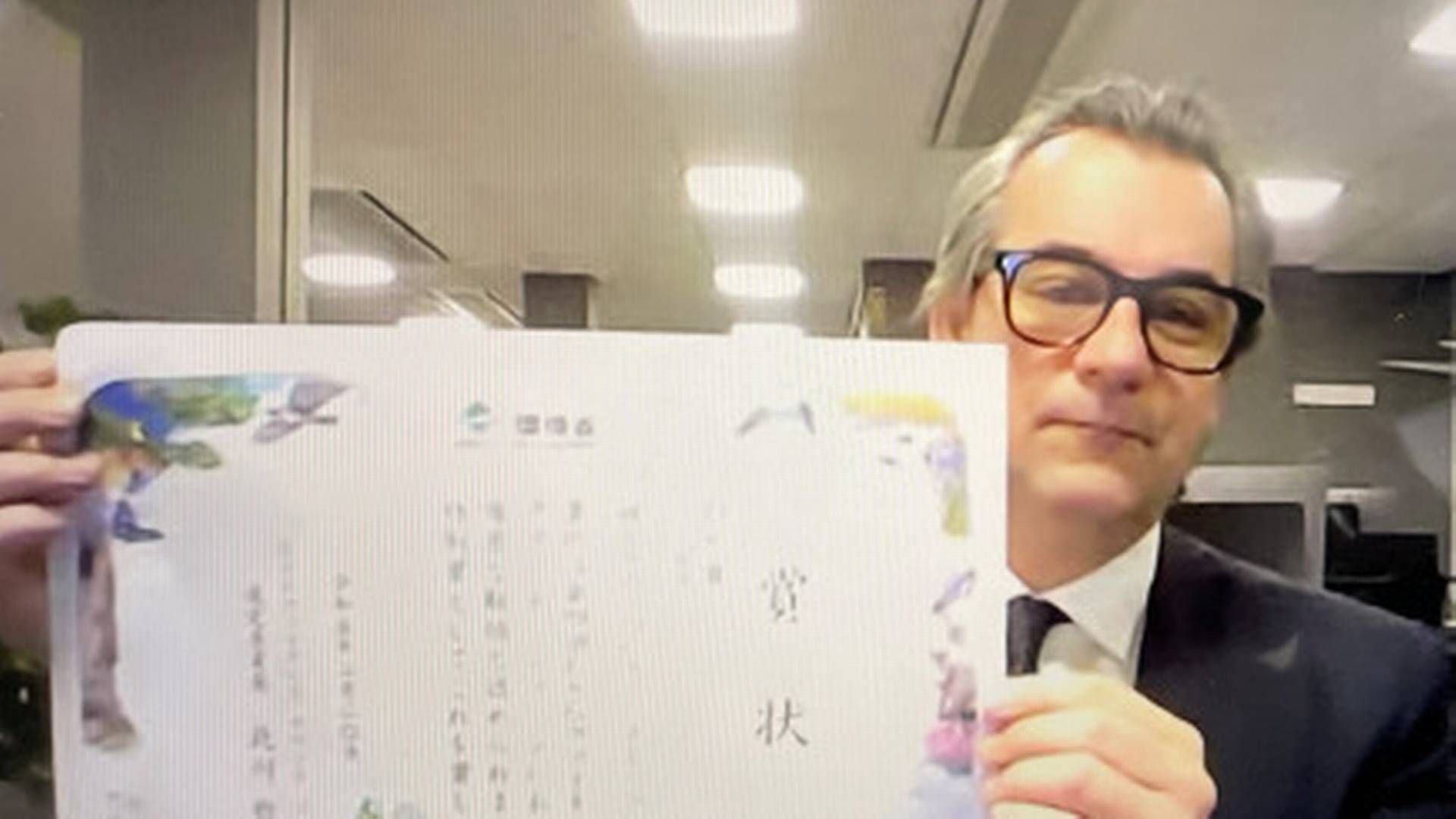

At the Fourth Annual ESG Finance Awards Japan, the country’s Ministry of Environment presented a special award in the asset manager category to SDG Impact Japan – a firm that specializes in sustainable finance – for its promotion of the NextGen ESG Japan fund.

In its comments on the reasons for the award, the Ministry noted that the fund “focuses on Japanese small-mid cap stocks, which are considered to have significant room for improvement in future disclosure and responses from an ESG perspective.

“Although the actual volume and scale of the fund in Japan are still small, it was selected for a special award because of its promising future development,” the Ministry added.

”Doing the right thing”

Beslik joined SDG Impact Japan last year as Chief Investment Strategy Officer. Reacting to the award, he tells Swedish business site Realtid that “this is huge, one of the biggest things I have done”.

“It is an honor and very important for our customers in Japan, and it also opens up new opportunities for us to attract investors and capital. For us, this is an acknowledgement that what we do matters, and that we are doing the right thing,” Beslik says.

“To enter such a big market as Japan, and work with a local team in Japan to build and manage a fund that wins the finest award, is incredibly cool,” he adds.

Beslik stresses that the work is not over, because radical change is needed in the way that capital is invested.

Tired of greenwashing

Before joining SDG Impact Japan, Beslik was PFA’s Head of Sustainability for just six months. He also spent many years in various sustainability-oriented roles at Nordea.

In an interview with AMWatch in May last year, he described his new job as a great opportunity that gave him the chance to construct his own “NextGen ESG family of products.”

Beslik is an outspoken critic of greenwashing in the financial industry.

“It’s almost gone too far now and become ESG on steroids, where everyone is either calling or marketing themselves under that label. But they’re not all sustainable, and they have to prove that their actions actually lead to a real change on the primary market,” Beslik has previously told AMWatch.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.