Hundreds of funds set to lose ESG rating

Hundreds of exchange-traded funds (ETFs) are set to be stripped of their ESG ratings, while thousands of funds will get their rating downgraded, Financial Times reports.

According to unpublished research by Blackrocks iShares, and a consultation of ESG-ratings by MSCI seen by the paper, the number of European exchange-traded funds with the highest ESG score, the triple A-rating from MSCI is set to go down from 1,120 to just 54, and funds with no rating will surge from 24 to 462.

The changes reflect a push by index providers to tighten up the criteria for what qualifies as an ESG-compliant fund amid pressure from regulators.

ESG-rated funds accounted for 65% of inflows into European ETFs in 2022, according to data from Morningstar.

The changes are due to be effective from the end of April and will apply to all ETFs and mutual funds globally.

Related articles

To upgrade or downgrade – Nordic managers disagree on SFDR

For subscribers

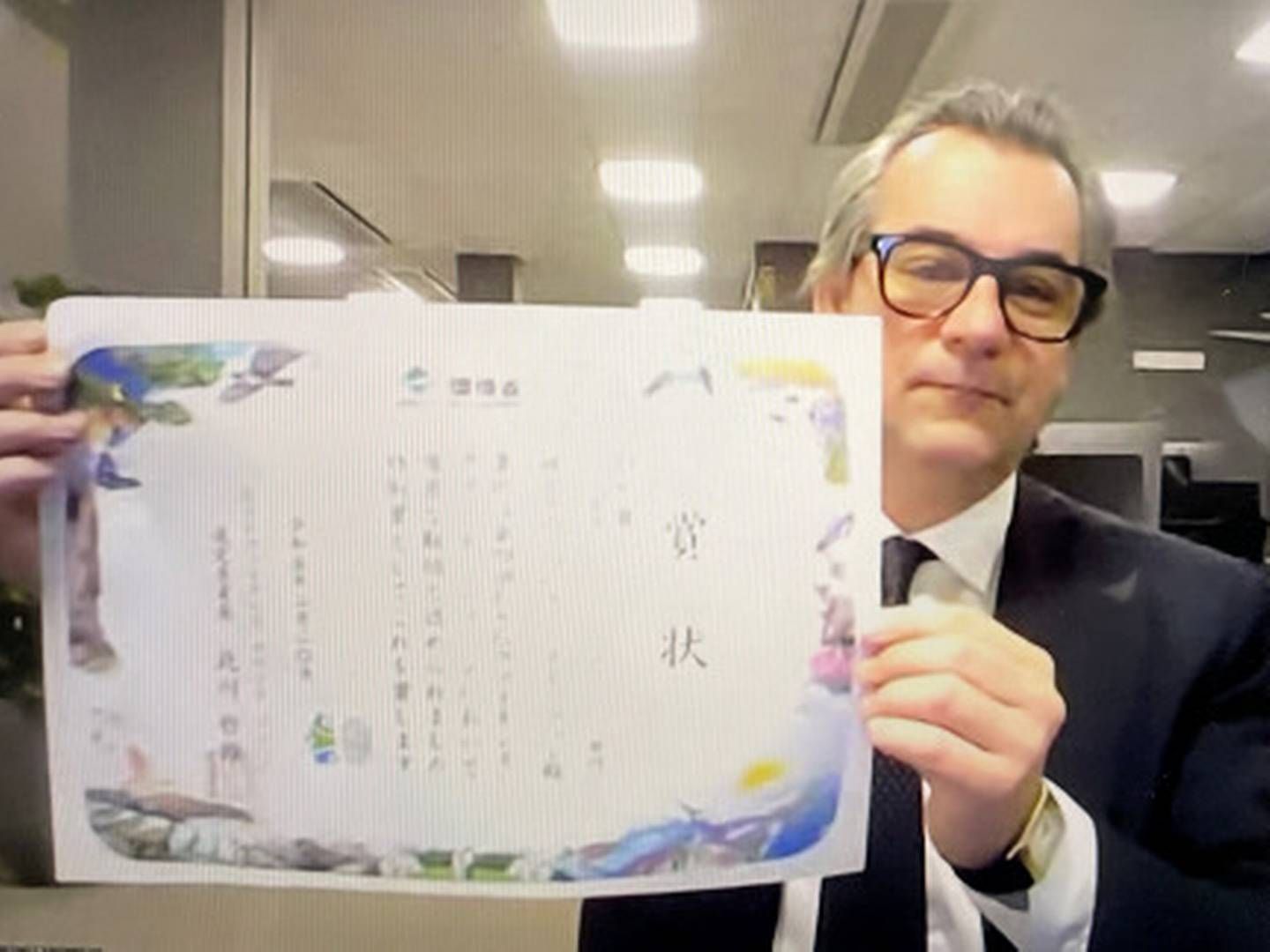

Beslik fund wins Japanese ESG award

For subscribers