Norwegian debt advisor: Changed market provides opportunity for international capital

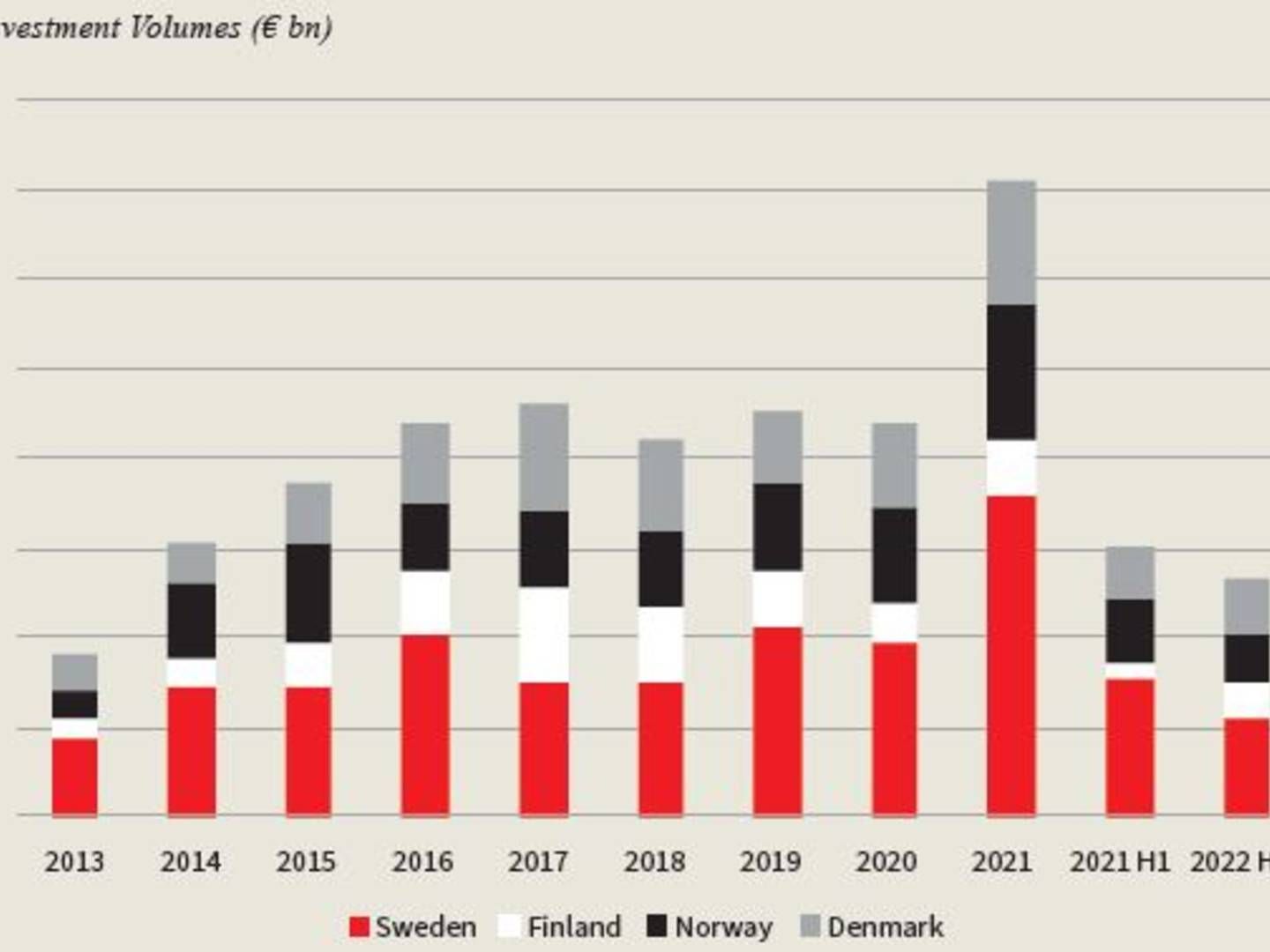

Investors are generally more cautious during times of change. However, there has been good activity on the Norwegian real estate market in 2022 despite geopolitical concerns, increasing interest rates and high inflation levels.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.